[BLK – Blackrock] Not Another Passive vs. Active Debate

Back in June 2009, reeling from the financial crisis and desperate to fix its balance sheet, Barclays agreed to sell Barclays Global Investors (BGI) to BlackRock, who paid ~$13.5bn in cash and stock for BGI’s ~$1tn in assets, which included $385bn in AUM from its vaunted iShares ETF franchise. Over the last 8 years, iShares AUM grown to $1.5tn today, compounding at 17% over the last 4-5 years, as capital has marched unrelentingly towards passive strategies, largely at the expense of actively managed ones.

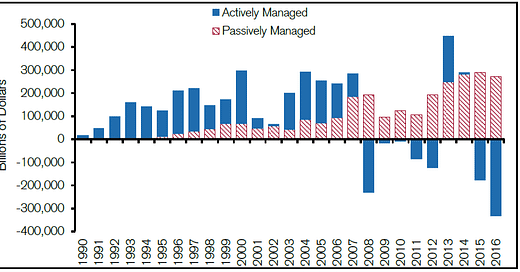

This shift to passive is aptly reflected within Blackrock’s own flows:

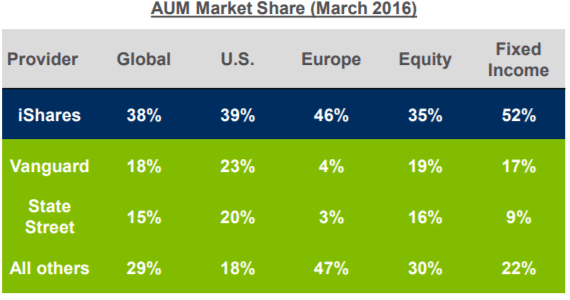

Today, iShares is the largest global ETF player by far, with over 2x the assets of each number 2 Vanguard and number 3 State Street. And collectively, these three comprise over nearly 3/4 of global ETF AUM (ex. Japan and China).

[According to Boston Consulting Group, North America and Europe constitute nearly 80% of global AUM (active and passive)]

To attract flows, a passive manager must offer a liquid product at a competitive price. The latter is contingent on having a cost advantage that sprouts from superior scale. By continually diluting largely fixed labor and technology costs across an ever larger asset base, you can profitably reduce your prices, invest in your brand, pay your distributors, introduce new products [there are light synergies between products. Multi-asset capabilities are marketed to institutions as solution sets, which drives adoption across several passive products at once], and attract greater trading volume in your ETFs, which compresses their bid-ask spreads and begets still more volume. BlackRock levies ~20bps on its equity products. An equity manager without the critical AUM mass of BlackRock/Vanguard/State Street would find it difficult to charge a comparably low rate and keep the lights on, let alone reinvest in the business and generate excess returns.

And as dominant as these three are in passive, there is still considerable runway. According to data from BCG, if we strip out alternatives, liability driven investing, target date funds, and other niche pockets, passive vehicles make up less than 30% of global AUM. BLK’s $3.6tn of index and ETF assets claim less than 10% of the addressable AUM pool.

[I think the updated figure for ETFs is now $4tn, but who’s counting?]

If you want to go crazy with the TAM, consider that there’s $160tn of global fixed income and equity securities, and what are ETFs but bundles of securities?

Of course, not even the most strident advocate of low-cost passive management claims that active strategies will be obviated entirely away. There is still a place for funds with illiquid positions and idiosyncratic concentrations that don’t hue well to indexation. But it’s hard to make the case that closet indexers, whose portfolios differ from their significantly cheaper indexed benchmarks only in modest over/under-weight tweaks, won’t continue losing significant share. This seems not only inevitable, but just. In 2016, US actively managed mutual funds experienced nearly $300bn of outflows (its worst year ever) and given the vast fee chasm between the two vehicles – investors pay ~80bps for an active mutual fund vs. just ~20bps for passive ETFs and index funds – relative to narrow differences in investment performance, I see no rational justification for why share donorship should stop.