CarMax, Carvana, and used car retailing

Related posts:

[KMX – CarMax; CVNA – Carvana] Moat, Growth, and Competition (Mar. 30, 2018)

[CVNA – Carvana] Fat tail investing (Aug. 13, 2020)

As previously discussed, the cost structure of used car retailing has become less variable, more fixed over the years. CarMax pioneered this transition in the early ‘90s, applying the lessons of mass retail from its now defunct parent, Circuit City. Rather that having a salesmen roaming small plots of land with limited inventory, relying on heuristics and rules of thumb to buy and sell cars through tense negotiations, CarMax concentrated units in large footprints with 4x-5x more inventory than the typical dealer, used technology to manage inventory and understand supply/demand conditions, and imposed no-haggle fixed pricing.

Twenty years later, Carvana pushed further along the variable/fixed spectrum. Used cars were refurbished and centralized in even larger 100k-200k square foot inspection and refurbishment centers (IRCs) facilities (a typical CarMax store ~40k-60k square feet). The stores and employees facilitating each step of sales process were replaced by substantial upfront investments in technology and last mile logistics, such that a shopper could feel okay about buying and funding a car without seeing it first in person, secure in the knowledge that what they previewed online was an accurate representation of what would be delivered to their front door. That a buyer’s expectations match what’s displayed on the website is critical given that Carvana offers free test drives and 7-day money back guarantees. Driving back out to pick up and re-refurbish a returned car destroys the unit economics of a sale.

At a system level, Carvana’s business model, which involves last mile delivery and pick-up, is more complex than CarMax’s, whose process in turn is more complex than those of traditional dealers. It’s just that with each business model transition, a greater proportion of that complexity is absorbed by the dealer, alleviating the absolute amount of hassle for consumers, resulting in more volumes and cross-sales. In other words:

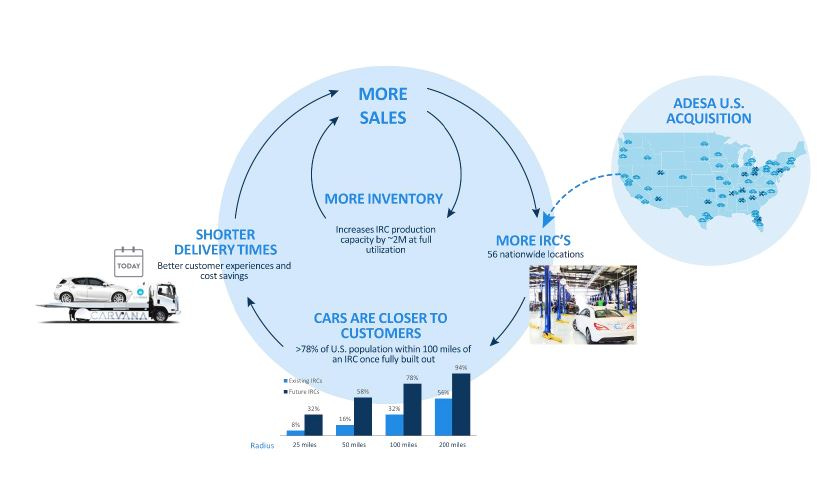

More IRCs → more inventory at closer proximity to more customers → shorter delivery times → better customer experience and higher conversion → more sales volumes leveraged over local IRCs and ad spend (repeat). The number and location of IRCs are key because buyers will weigh Carvana’s selection and delivery times to what’s available from nearby dealerships. Having a greater variety of cars in stock at a national level than any local dealer doesn’t matter if it takes 2 weeks to deliver a certain model to a certain market. A buyer will just visit one of the, say, 3 dealers within a 10 mile radius of his home. If Carvana carried twice as much same-day inventory as all local dealers, then it could stand to take major share. According to this Tegus interview with a Former Sr. Product Director at Carvana, going from even 1 day to same day deliveries translates into material conversion improvements (”people are remarkably more impulsive than you would think about a huge purchase.”). But of course, it doesn’t make sense to build a $40mn IRC solely to offer same day delivery to a market where the nearest competing pool of inventory is like 100 miles away, as buyers there might be fine waiting 5 days given the alternative of driving several hours to scope out a more limited selection.