[IAC; ANGI] Yet another IAC write-up

I’ve heard it said that in its early days the consumer internet was treated as another place to replicate tried-and-true practices from the offline world. Newspapers and magazines were thriving under a hybrid subscription and ad-based model, so it made sense that even as it collected ad revenue from service providers, Angie’s List charged consumers to access its site. I guess it figured homeowners would pay $60/year for authentic reviews that de-risked the process of finding qualified plumbers, electricians, carpenters, and other contractors. For a time, they were right. Paid memberships grew by 48%/year from 2007 to 2013. But at some point, with HomeAdvisor and Google offering free access to those same service providers, charging consumers no longer looked like a good idea.

So in early 2016, with membership growth decelerating and revenue per member and per service provider plummeting across cohorts, AL dropped its consumer paywall. The following year profile views doubled, traffic and written reviews ballooned by 4x-5x, and consumer memberships spiked by 55%:

But even as it lured more traffic, Angie’s List struggled to engage service providers on the other side of its network. Still pattern matching offline best practices, the company locked SPs into $4k-$5k annual ad contracts at a time when HomeAdvisor (and just about every other online matchmaking business) was following Google and charging per click. In 2016, the number of service providers on AL began to flatten and ad revenue declined, even as growth in consumer memberships accelerated. Angie’s List was starting to look like TripAdvisor: a recognizable brand that couldn’t convert its considerable traffic into profits.

Meanwhile, HomeAdvisor, known as ServiceMagic at the time IAC acquired it in 2004, was soaring under a model that granted consumers free access to the site while charging service providers membership and lead gen fees. Under a separate subscription, SPs could also use HomeAdvisor to manage their workflows, create invoices, and process payments.

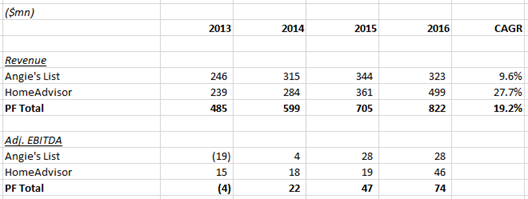

Angie’s List ran a business model was inferior to HomeAdvisor’s but had far more brand resonance and traffic. So HomeAdvisor tried to acquire its ailing rival in November 2015. The unsolicited offer was rejected by AL’s Board, who owned 20% of shares and believed that management could reverse the company’s diminishing fortunes. 1.5 years later, with no signs of the turnaround bearing fruit, AL put itself up for sale. IAC bought it, merged it with HomeAdvisor and renamed the combined company ANGI Homeservices.

The acquisition fused AL’s brand and consumer traffic with HomeAdvisor’s service provider network and monetization engine. Or to put it another way, IAC purchased a cheap customer acquisition channel for HomeAdvisor.

Up until maybe 2014, AL and HomeAdvisor’s main value proposition to consumers was aggregating local service provider reviews and ratings in one place, a useful service to be sure but one that Google got better at over time and offered for free. On Angie’s List or HomeAdvisor, only after I click through menu options (drain clearing, pumps, sprinkler systems, water heaters) and answer a series of questions (zip code? Is this an emergency? How many drains are clogged? When do you need the project done? Home or office?), will I be connected to qualified service providers…OR I can just type “Plumber in Portland” into the Google search box and within seconds get this:

If your goal is to simply find a plumber with lots of solid reviews and ratings, Google will get you most of the way there.

I’ve written before that to reclaim value from Google and Facebook, online lead gens have been forced to migrate down-funnel and bear more responsibility for curation, payments, and bookings.

To stem the siphoning of value at the top of the funnel, many lead gens have migrated down funnel, processing transactions, qualifying leads, and generally doing things that a massive horizontal aggregator is not set up to do. HomeAdvisor launched Instant Booking for service providers, TripAdvisor did the same for hotels. Angie’s List offered service quality guarantees for paying members in which it would either intercede to resolve any transaction issues or reimburse the consumer, and as part of its turnaround effort prior to being acquired by IAC, planned to offer a platform for service providers to manage payments, scheduling, and marketing. Yelp lets consumers to reserve seats and join waitlists at restaurants and, through its Request-A-Quote feature, allows homeowners to see how long it typically takes for a service provider to respond to quote inquiries. A few years ago, in an effort to improve lead conversion, LendingTree began playing a bigger role in directing consumers to particular lenders…

The reviews and ratings that accompany Google’s listings may provide a directionally right sense of which service providers are trustworthy, but you will still have to call several of them, describe the project and then compare their availability and rates. While answering questions on ANGI’s requires a bigger upfront investment, these are questions that every plumber you vet will ask anyways. Better to go through the questions once and have an intermediary use the answers to find the right person for your job.

In Lead Gen, Marketplaces, and Scale Economies I surmised that Google’s reluctance to trek down-funnel played a role in the failure of Google Compare, a personal finance comparison network that matched consumers with financial products:

…I will speculate that Compare didn’t work because lending partners weren’t realizing satisfactory conversion rates relative to the what they otherwise could have realized through Ad Words, and the reason they weren’t was that too much consumer-friendly, search engine DNA was infused into Compare’s matching process. While it may seem that LendingTree’s new selection-based model, where consumers choose which lender to engage with, is nothing more than a Compare copy-cat, it in fact differs in one crucial way: Google Compare was a content site that filtered lenders for the benefit of consumers; LendingTree, by requiring prospective borrowers to run through a gamut of questions about themselves before being presented with offers, filters consumers on behalf of lenders.

Compare’s selling point was that consumers could pick and choose their own screening criteria and didn’t have to include highly personal information about themselves. But in fact, personal information, systematically collected across all consumers, is required to direct the right leads to the right providers and maximize the chances at conversion.

ANGI deliberately introduces friction on both sides of the platform – consumers spend a few minutes answering questions and service providers detail the specific kinds of projects they can take on and at what dates, times, and zip codes – but the upshot is that consumers save more time in total and service providers get better qualified leads. A business like ANGI’s that finds intersections across project, time, date, and zip code won’t grow as rapidly as one that merely lists names and reviews, but it is far more difficult for a new entrant to replicate and less likely to attract Google’s interest.