[LYV – Live Nation] On Flywheels and Bundles

In my last blurb on Live Nation, I fussed over impending competition from Amazon, which was populating its US site with “Amazon Tickets” job listings that included the following salvo:

“The ticketing business is ripe for innovation and improvement, as much of the industry has not fundamentally changed since the 1970s.”

With Ticketmaster controlling 80% of ticketing for major live event venues under 3-5 year distribution exclusives, my theory was that Amazon would start off as a mere distributor for Ticketmaster in the US, but would over time integrate lessons and data gleaned from that arrangement with customer preferences from other parts of its business to create better concert and music recommendations, bringing more fans to venue clients and bolstering the value proposition of Prime. Meanwhile, it would ink new ticketing agreements with venues as their contracts with Ticketmaster rolled off.

Looks like I was wrong. In February 2018, Amazon shuttered its UK operations, 4 months after also calling it quits in the US. From TicketNews:

Amazon’s foray into the U.S. market reportedly stalled when it couldn’t come to an agreement over distribution with Ticketmaster. Amazon was reluctant to share data on its Prime customer database with the other corporation, and Ticketmaster proved a difficult foe to push through to make direct connections with venues or promotions due to its exclusive contracts with such a high percentage of them. Reportedly, Ticketmaster had pushed for Amazon to become an outlet more for its less-desirable stock at bargain prices rather than a place where consumers could find high-demand shows and events.

Although, according to Bulletin:

Amazon is shuttering its U.K. ticketing business, but might be quietly preparing for a 2019 relaunch with new technology and tie-ins with Amazon Echo and Firestick, Billboard has learned.

The online retailer had been using technology by London ticketing software firm Ingresso to power some of its online sales in the U.K. But late last year, Amazon officials began quietly meeting with show producers at its Seattle headquarters with a presentation detailing plans to phase out the current ticketing program and replace it with a new ticketing platform tied into Amazon devices like the voice-activated Echo speaker and the Firestick TV streaming device, utilizing its AI-driven personal assistant software Alexa to make searching for tickets easier.

But if Amazon were really planning to re-launch with its own software platform, why squash nascent efforts in the US at around the same time these conversations were had and then completely shut down in the UK, where the competitive environment is easier? Regardless of whether or not Amazon eventually re-appears in ticketing, my main error is that I was far too caught up with the presumption of Amazon dominance generally and didn’t think critically enough about whether it made strategic sense for Amazon to compete in this space, even assuming it had the resources to do so. I should have been asking why ticketing might be important to Amazon before speculating on how it would go about doing so. An ideal product category for Amazon is one that regularly touches consumers on a large scale and in so doing, reinforces Prime’s value proposition, cross-collateralizes consumption of complementary products and services, and improves customer retention. Within that framework, the payoff in pursuing primary ticketing seems questionable.

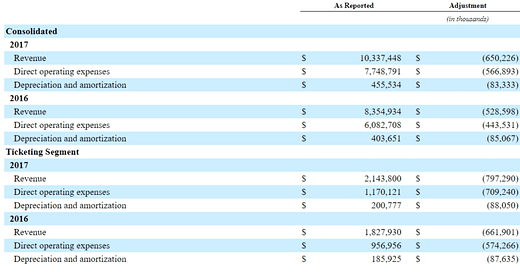

First, it’s a relatively small market. Even with 80% of share of primary live event ticketing for major concerts in the US, Ticketmaster recognizes just $2bn in total revenue. StubHub, with greater than 50% share of the resale market, generates just $1bn in transaction revenue. And sure, one might argue that the market is benefiting from secular trends – experience > things for millennials + artists relying on concerts for a growing proportion of their income – but concerts don’t represent some tectonic paradigm shift in music consumption with tons of white space; primary ticketing is a mature market dominated by a deeply entrenched monopolist with a lock on the most attractive venues. Second, the magnitude of ticketing’s contribution to Amazon’s flywheel is less obvious to me than Ticketmaster’s value to Live Nation’s vertical bundle. Do ticket purchases materially improve Amazon Music’s recommendation engine? Would “loss-leading” on tickets drive a meaningful inflection in sign-ups and engagement with Prime or Amazon Music or Alexa? Would these benefits justify what is sure to be a costly and protracted battle with a determined Live Nation?