[MELI – MercadoLibre] Digging The Moat (Or Is It A Grave?), Part 1

A few weeks ago, I came across the following remark from Joe Weisenthal in my Tweet feed:

“Smart people can’t help but try to poke holes in things, and see the weaknesses in existing systems. But long-term investing requires a certain amount of dumb confidence that things will all work out over time, even if at any given moment the headlines look awful and valuations don’t seem to make any sense.”

That seems as good an intro as any to MercadoLibre, one of the largest e-commerce players in Latin America.

Overview

In Latin America, e-commerce constitutes just under 3% of retail sales (up from 1% in 2009), which is about where the US was in 2006. Remember 2006? The first iPhone hadn’t yet been launched, Myspace had nearly 10x more users than Facebook, Amazon’s North American e-commerce revenue was 7% of what it is today, and eBay’s market cap exceeded Amazon’s (today, Amazon is >10x larger than eBay by market cap).

We know where to take the narrative from here, right? Some variation of, “China’s e-commerce is 15% of retail sales; if country X gets there, that implies…” But while online sales penetration does indeed seem mostly inexorable the world over, it is proceeding at varying rates across countries, as the below exhibit makes clear…

Contrary to intuition, this exhibit suggests that the change in e-commerce adoption is not really correlated to the pace of internet penetration. For instance, Thailand and China both saw similar growth in internet penetration, and yet the change in e-commerce share in the latter has trounced that of the former. The US and South Korea, already mature internet economies in 2010, saw little incremental internet penetration in the subsequent 5 years…and yet, they nonetheless saw significant e-commerce share gains, gains that far exceeded those of less developed countries with far greater moves in internet penetration. Nor does there seem to be a relationship between internet penetration and e-commerce adoption levels. For instance, India’s e-commerce share is comparable to Brazil’s despite having 1/3 the internet penetration. China’s internet penetration lags Brazil (and the US, UK, France, and Japan) and yet, the country’s e-commerce share of retail is greater than any of them.

This not to say that some basic, core infrastructure like broad-based internet accessibility isn’t an exogenous necessity; just that, it is insufficient in itself to drive e-commerce adoption. Obviously, nuanced cultural, demographic, and historical factors explain part of the the variation in online sales across countries. But also, e-commerce doesn’t just happen. Adoption is largely endogenous to efforts of the e-commerce winners themselves. In China, it’s not like there was some nebulous white space called e-commerce that Alibaba, Tencent, and JD just stepped into and owned. These companies bootstrapped payments and logistics and essentially created the market. E-commerce did not enable these giants; these giants enabled e-commerce. The slope of that red line would be much shallower without these three companies.

I sort of see Latin America the same way. There will be 1 or 2 players in each country that, en route to forging their own paths to dominance, will dictate the rate of e-commerce adoption over the next decade. The core, enabling substrate continues to solidify: internet users have gone from 22% of the population in 2007 to 55% in 2016, smartphone sales as a percent of total handset sales have increased from 6% to >50% over the last 7 years, and the number of smartphone users are up by nearly 2.5x over the last 4.

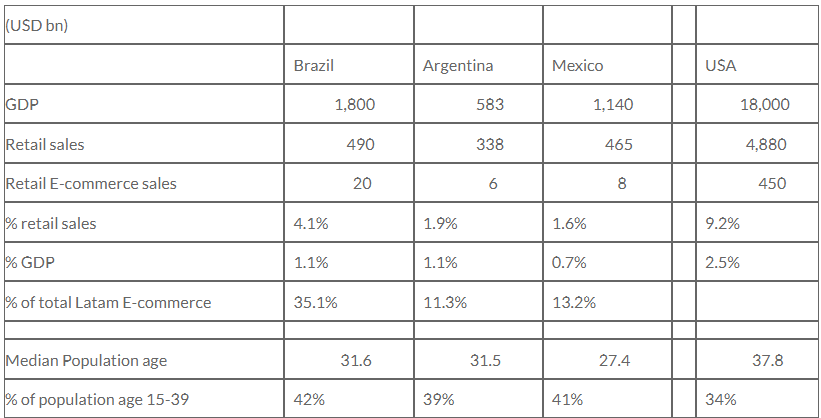

Isolating the region’s 3 largest e-commerce markets – Brazil, Mexico, and Argentina – that make up 60% of Latam e-commerce and ~90% of MELI’s marketplace revenue, we see that relative to the US, there’s still plenty of e-commerce penetration opportunity to be had and a relatively young, highly urbanized population to move the ball forward.

Nested within these favorable demos is MELI, which operates one of the largest e-commerce marketplace (MercadoLibre; fixed price and predominantly B2C) and payments platform (MercadoPago) across 18 countries in Latin America.

[Gross Merchandise Value: the dollar amount of all transactions on MELI’s platform, of which the company takes a percentage]