Remitly looks interesting

It may not be entirely fair to think of Wise as “cross-border transfers for yuppies”, but that’s just where my mind goes. After all, the company grew out of a scheme devised by two white collar professionals – Taavet Hinrikus, a Skype employee in Estonia, and Kristo Kaarmann, a Deloitte consultant in the UK. Taavet funded Kristo’s bank account in Estonia while Kristo funded Taavet’s bank account in the UK, allowing each to bypass onerous bank transfer fees. We’re not talking about migrants sending money to indigent family members who would otherwise struggle to pay for groceries. Kristo needed Estonian kroon to pay off his mortgage.

Remitly was founded on a crunchier premise. Its founder, Matthew Oppenheimer, was working on mobile banking initiatives for Barclays Bank in Nairobi when he experienced firsthand how inconvenient and expensive it was to send money back home to people who depended on remittances to meet day-to-day needs (”we send life-changing transfers”). Remitly began by facilitating remittances from the US to the Philippines in its first few years, then expanded to India and Mexico. More than a decade later, those original three destinations still anchor the business, accounting for roughly half of Remitly’s revenue.

Wise positions itself as a cold utility, optimizing for cost and speed. Remitly, by contrast, stresses the “emotional weight” of getting non-discretionary funds to their destination on time. Saving a buck or two on a $200-$300 transfer matters less than ensuring mom and dad have the money to pay for food and medicine. As Remitly’s Chief Business Office recently put it: “When you deliver the most trusted, reliable, fast, simple and delightful experience, price becomes just one part of the value equation. Customers don’t stay with Remitly because we are the cheapest. They stay because we are the most trusted, transparent and fair.”

Trust. Management repeatedly points to various proxies for this north star…4.8+ stars on Google Play and iOS, a Trustpilot score of 4.6 with over 5mn reviews, 94% of transactions completed within an hour, 63% instantly. And having proven itself in low-value, emerging-market remittances, Remitly is expanding in several different directions at once.

It has been gentrifying toward higher-value senders – $1,000+ transfers in select corridors like US-to-India – whose share of total volume has risen 2-3 points over the past year to roughly half of all monthly send volume. Large transactions tend to generate more lifetime value than small-dollar transfers, even at lower take rates and less predictable transaction patterns, as they exhibit lower fraud rates and skew toward digital disbursements and away from expensive cash pickups. The dilutive effect of high-value transfers explains why management rightly discourages take rate as a KPI. Realizing 0.5% on a $10,000 transfer is plainly superior to earning 3% on $500.

Remitly has also started targeting freelancers and micro-enterprises, a lower-churning segment that overlaps heavily with the core customers that Remitly already serves but that transacts at twice the size and frequency.

Alongside its move into new customer segments, Remitly launched a burst of new products last year:

Remitly Wallet: a multi-currency stored-value account where users can hold fiat and USDC.

Remitly Card: a debit card linked to Remitly Wallet that allows users to spend balances through Apple Pay or Google Pay (physical cards not yet available, but coming this year) on everyday purchases at home or abroad.

With Wallet and Card, consumers can store value across currencies, convert them as needed, and spend locally without having to open separate bank accounts in each country. Remitly earns revnue on Wallet the same way it does on any cross-border transfer, by taking a slice of converted volumes, and monetizes Card through interchange fees.

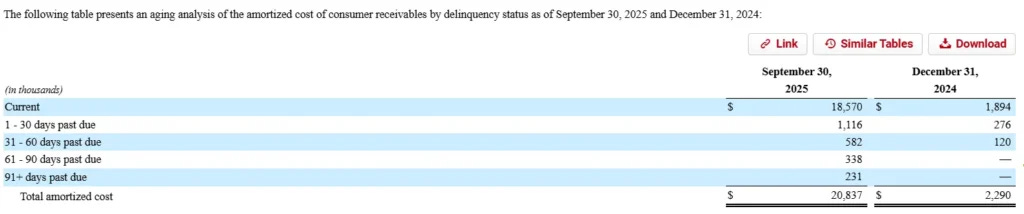

Remitly Flex: a send-now, pay-later cash advance, no interest cash advance designed to smooth cash-flow gaps so customers can help recipients cover urgent needs. Remitly carries these receivables on its balance sheet (for now) and limits credit risk by capping advances to $250, setting short repayment windows, and offering the product only to “trusted senders” with established remittance histories. Since the program’s inception, charge-offs (120+ days past due) have been immaterial and 90+ delinquencies are negligible, though it’s worth noting that roughly 10% of Flex’s balances are non-current:

Remitly One: a subscription-based membership that management likens to Amazon Prime, designed to encourage habitual use of multiple products by offering perks across them. For example, Remitly One subscribers earn rewards on Wallet balances, including a 4% annual boost on USD holdings. They can repay Flex balances over 90 days instead of over 30 and their Flex recipients get instant access to funds rather than having to wait three days.

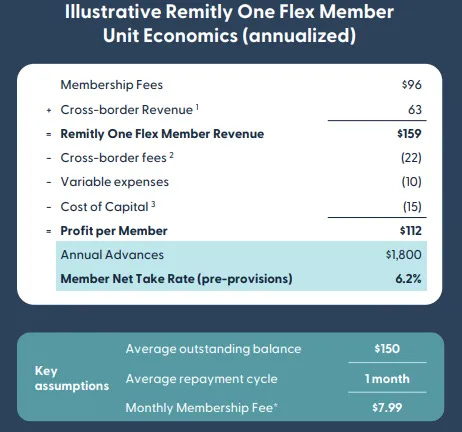

In its recent Investor Day, Remitly broke down the unit economics of a Flex transaction from a Remitly One subscriber, which works out to a take rate of 6.2%, compared to 1.5% for the core consumer business. After taking loan loss provisions into account, management claims the take rate is still “at least double” the core.

(”Illustrative allocation of $9.99/month Remitly One membership fee to Flex, after other benefits; 1 Assumes 3.5% take rate, 2. Assumes 35% of cross-border revenue, 3. Assumes 10% of outstanding balance, 4. Net take rate = RLTE / Send Volume, 5. ROIC calculated as net take rate dollars associated with the Flex product as a percentage of average outstanding Flex balances”)

The fanfare around these budding initiatives and Remitly’s ongoing success growing customers and send volumes have been overshadowed by persistent fears over the impact of stablecoins. Management has tried flipping the narrative, framing stablecoins as a technology that reinforces, rather than disrupts, Remitly’s offerings.

They classify stablecoin use cases into two categories: Infrastructure and Wallet. The Infrastructure use case has primarily to do with treasury management. One annoying problem that Remitly faces is that it operates 24/7 but its bank partners do not. If Remitly expects strong demand for PHP on Saturday afternoon, it needs to make sure accounts at its Philippine bank partners, who are closed on weekends, are funded with enough pesos by 5pm Friday (or whenever the settlement cutoff time happens to be). But in doing so, Remitly is shouldering the risk that the USD/PHP exchange rate moves against them between when they pre-fund PHP in advance of weekend demand and when they must replenish the PHP currency pool when the FX market reopens. As Remitly explains in its 10K:

To enable disbursement in the receive currency, we prefund many disbursement partners one to two business days in advance based on expected send volume. Foreign exchange rate risk due to differences between the timing of transaction initiation and payment varies based on the day of the week and the bank holiday schedule; for example, disbursement prefunding is typically largest before long weekends.

It can hedge this risk or keep credit facilities on standby to meet transfer demand, but neither of those options are free and the more illiquid and volatile the local currency, the more acute these issues become. In certain corridors, stablecoins give Remitly a way to move value instantly between markets, even over the weekend when most banks are closed, and convert to PHP much closer to when payouts actually happen.