Nobody talks about Charles Schwab anymore, but just two and a half short years ago everyone had an opinion…and if you roamed the Twitter hellscape back then what you found was that the most amplified takes converged on one conclusion: Schwab was teetering on the brink of collapse.

To recap: the most significant way Schwab makes money is by “sweeping” cash balances from client brokerage accounts to its bank, which invests that cash in US government-backed securities while paying virtually nothing on clients’ swept cash. When yields are razor thin, as they were four years ago, clients generally don’t care. They could invest those cash balances in a money market fund to earn like ~1.5% instead of ~0% but, eh, why bother.

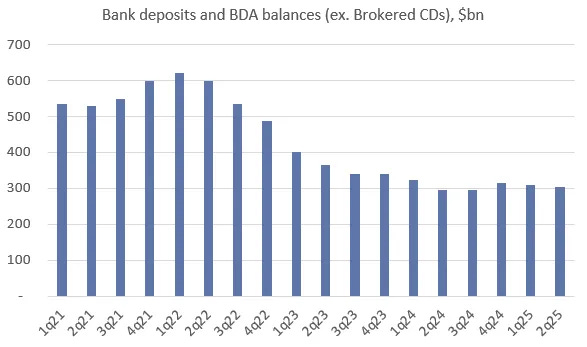

Schwab assumed that even in rising rate environment, cash sorting – when idle cash is moved out of sweep deposit accounts into higher-yielding alternatives like money market funds, CDs, or Treasuries – would remain limited. Yes, clients would rationally move sidelined cash into higher-yielding securities rather than charitably allowing Schwab to pocket those yields for itself. But whatever income was lost on bank deposits that fled for juicier money market yields would be more than offset by the gaping spreads earned on the vast majority of deposits that stayed put.

This assumption was violently tested in 2022, when the Fed ratcheted rates from 0% to 4%, the fastest pace in more than forty years and, for a time, seemed validated. Net interest revenue surged to $10.7bn in 2022, up from just $8bn the year before, as expanding net interest margins – the income earned on interest-bearing assets minus the interest paid out on liabilities – more than offset the impact of flattening, then declining, deposits in the back half of 2022. But things only got worse from there. Rather than abate in 1q23, deposit outflows accelerated as Silicon Valley Bank collapsed and panic ensued, to such an extent that net interest revenue began to contract y/y.

(BDA balances refers to TD Ameritrade deposits held at TD Bank)