some thoughts on Fiserv / First Data (FISV) and Guidewire (GWRE)

Fiserv (FISV)

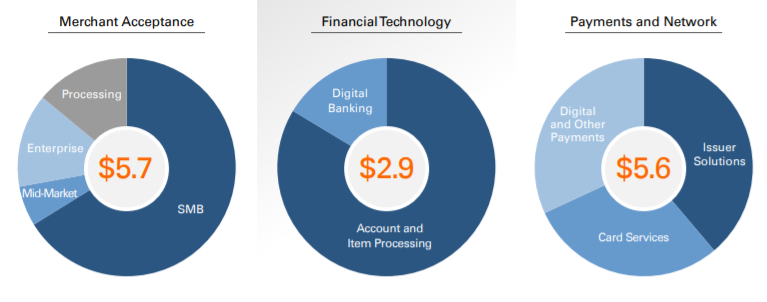

Even as the largest merchant acquirer and issuer processor in the US, Fiserv is overlooked amid the fintech jubilee. You should read my 4 part post on merchant acquirers for more detail but to recap, a few years ago Fiserv and First Data merged in a $22bn all stock-deal. The combined business now looks something like this:

Merchant Acceptance

First Data is the largest merchant acquirer in the US, with 40% share of physical point-of-sale. It got that way by partnering with banks, who distributed First Data’s point-of-sale solutions through their vast branch networks. And this worked fine so long as merchants looked to banks as the starting point in setting up a business and commerce was relegated to physical stores. But of course, now a merchant can launch their POS systems in minutes with a $50 dongle from Square, and sell through online platforms whose payments are powered by Stripe. In response, First Data, via its acquisitions of CardConnect and BluePay, began distributing through SaaS platforms (“integrated payments” or “Independent Software Vendor – ISV”, analogous to Stripe Connect), and replicating Square’s light touch in the offline channel through its acquisition of point-of-sale terminal/software vendor, Clover.

Payments and Networks

Fiserv’s Payments segment is perhaps best known for its issuer processing business:

Issuer processors are to card issuing banks what merchant acquirers are to merchants. They authorize and process transactions on behalf of card issuing banks under long-term agreements and recognize revenue based on a combination of transactions, cards on file, and licenses. Like merchant acquirers, issuer processors have countered the commodification of transaction processing by layering on services like analytics, fraud detection, and customer service (call centers). So today a bank might rely on its issuer processor to sort through transaction data to detect fraud patterns, increase credit limits, or market credit offers to certain cardholders.

Source: scuttleblurb

Fiserv and First Data were both involved in issuer processing businesses, Fiserv in debit and Fist Data in debit and credit. Each company also had debit rails that competed with those of Visa and Mastercard. Post-merger Fiserv is now the largest issuer processor in credit and debit, and owns the third largest debit network. When most think about the competitive challenges to Fiserv, they focus mostly on merchant acquiring. But fintechs are also attacking issuer processing, with Stripe Issuing, Marqeta ($14bn market cap, 30x revenue), Lithic ($800mn valuation), Sofi (Galileo) and others bringing modern, API first solutions to bear.

Fiserv’s serves traditional financial institutions who issue cards to businesses and consumers; Marqeta’s serves platforms and marketplaces like Square, Affirm, Instacart, DoorDash, Klarna who want to manage their own card programs, enabling them to approve transactions based on custom business logic; fund cards at the time of the transaction; and reconcile transactions with general ledgers. Klarna uses Marqeta to immediately pay merchants with virtual cards (see my WEX post for a discussion on virtual cards); Square to issue cards to merchants and Cash App users (70% of Marqeta’s revenue last year came from Square); DoorDash to pay restaurants at point-of-sale.

Marqeta powers DoorDash’s Red Card, the proprietary, instant-issue physical credit card that Dashers use to pay thousands of restaurants in three countries directly at the point of sale. Using Marqeta’s modern card issuing platform, DoorDash has the ability to control what is being purchased and to avoid fraudulent charges. When a Dasher pays for food with the DoorDash Red Card in a restaurant, the transaction is only approved and funded if the order and amount match the customer’s order in DoorDash’s system.

(source)

It recognizes interchange fees as revenue, much of which is shared with customers to incent more volumes. Marqeta, like Stripe, plays on this fusion of software and payments. It has 5x’ed total payment volumes since 2019 by winning over developers at engineering-driven hypergrowth platforms, particularly Square.

In addition to issuer processing and debit rails, Fiserv’s Payments and Network segment also includes some more exciting stuff like electronic bill pay and P2P technology. To highlight its dynamism, Fiserv often points to the rapid uptake of Zelle: