thoughts on Guidewire, Wizz Air, and Upwork

Today I want to talk about 3 stocks I own that have gotten smashed this year: Guidewire (-48%), Wizz Air (-66%), and Upwork (-60%).

Guidewire (GWRE)

I’ve written about Guidewire before (here and here). To recap: with 40% of policies are still processed on mainframes, the P&C insurance industry is long overdue for an upgrade. Insurers should be underwriting risk and investing float not hiring software engineers and data scientists to build core systems in house. Rather than spend years and hundreds of millions building a modern stack, it makes far more sense to pay ~50bps of premiums to Guidewire, who has spent the last 20 years on honing this one thing. In that time they’ve established a leading market position, with 20% of the industry’s premiums now running through at least one of its core modules. They claim to be winning close to 3/4 of core systems decisions, even more by premiums. Testament to its success, Guidewire’s software revenue has steadily compounded by 16% over the last 9 years.

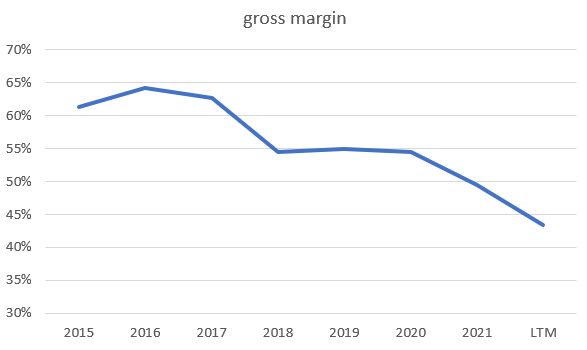

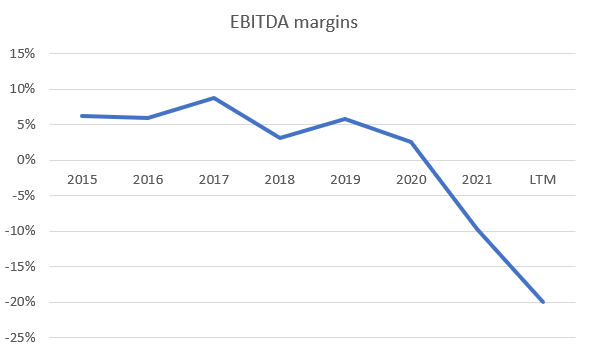

And yet:

(20XX = fy ending July 20XX)