[TRIP – Tripadvisor] Good Asset, Fumbled Monetization Strategy

For many years prior to 2012, Tripadvisor was accused of “over-monetizing” its site, bombarding visitors with “pop-up” windows that redirected visitors to the sites of its OTA and hotel ad partners. In late 2012/early 2013, TRIP began replacing the antiquated pop-up model with in-line meta (so visitors could compare rates across different OTA and hotel properties directly on the Tripadvisor site), starting on mobile, where pop-ups really made zero sense. The swap initially resulted in lower revenue as the stronger cost-per-clicks (CPCs) from better conversion (customers were more likely to complete a booking when clicking on a metasearch link than on a pop-up ad) failed to fully compensate for the loss of clicks that accompanied the new monetization model.

Still, metasearch did not fully redress a significant value leakage problem, particularly on mobile. A traveler would visit Tripadvisor’s site to check out the reviews as part of their research…but rather than click on the corresponding links during his visit and suffer through the unwieldy experience of completing a booking on the small touch screen of his smart phone, the visitor would instead book the hotel at a later time by going directly to the OTA/hotel site, cutting TRIP out of the transaction loop. There was no way to tie that booking back to the original Tripadvisor visit that pressed the visitor to book the room in the first place, and so OTAs and hotels couldn’t validate how valuable Tripadvisor was as a traffic source, leading them to systematically underbid metasearch clicks on Tripadvisor’s site.

And so starting in 2014 and throughout 2015, to palliate mobile conversion cramps and close the “monetization gap” (the wide disconnect between the value that Tripadvisor offers to visitors and the value it extracts from them), TRIP rolled out Instant Booking in the US and UK.

[The mobile channel realizes just 1/3 the per visitor economics as desktop even while it now constitutes the faster growing ~half of TRIP’s total traffic. ~1/3 of desktop monetization today is a big improvement from 19% at the start of 2015…but by management’s own admission, the improvement in mobile monetization would have happened even without IB.]

Under the Instant Booking model, the OTA and hotel partners still list their room inventory on Tripadvisor as before but the clicker, rather than being forwarded to the OTA/hotel’s site, now completes his booking directly on Tripadvisor, with the OTA/hotel partner processing the transaction and handling the customer. Instead of getting paid per click, with IB the company now receives a commission from the booking partner. [Instant Book does not replace metasearch, which is still an option for booking partners]. At the time of roll-out, management’s hope was that Instant Booking would drive better conversions (percentage of clicks that convert into bookings) than meta and importantly, by keeping visitors on the site, inspire more direct repeat booking business. By mid-2016, Priceline and most of the major hotel chains had signed up for Instant Booking (while also keeping their presence on meta). Expedia joined too, at the end of 2016, after certain exclusivity provisions between Priceline and Tripadvisor had expired.

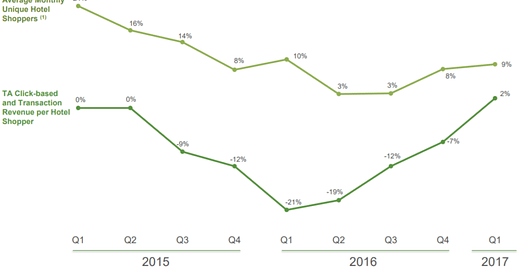

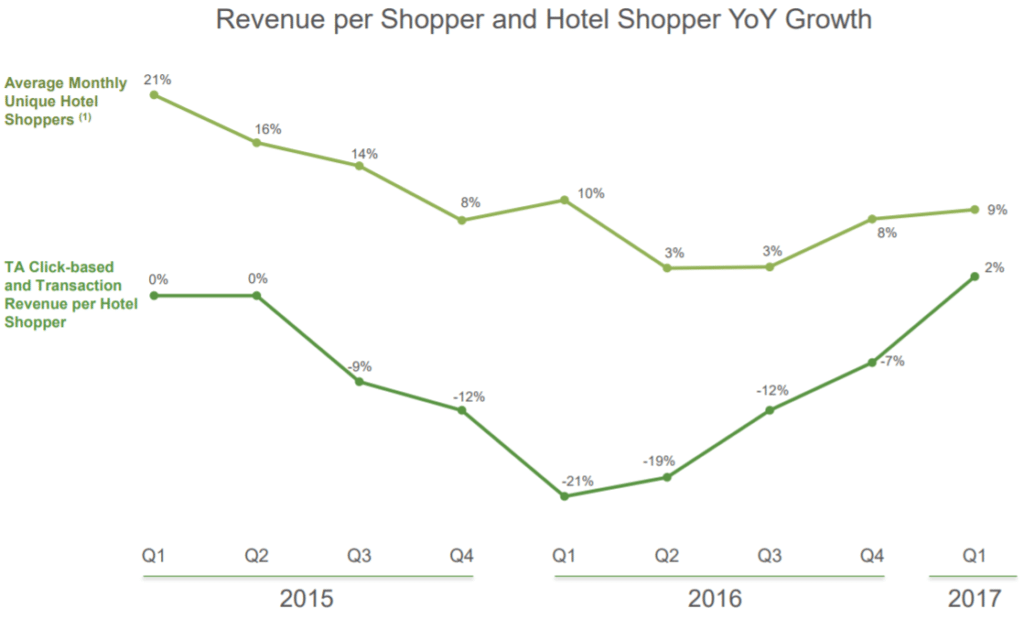

Even so, since embarking on IB, the company’s results – decelerating monthly unique shoppers growth, contracting transaction revenue per shopper, and shrinking hotel margins – have been disappointing:

[hotel shoppers: visitors who view a listing of hotels in a city or visitors who view a specific hotel page]

Throughout 2015, management urged investors not to freak out, reminding them that as with transition from pop-ups to metasearch, shifting to Instant Bookings would come with growing pains but that ultimately, better click conversions would be a boon to CPCs. But over the last several quarters, management has changed its tone…

“We want to do what’s best for our travelers. And we believe that Instant Book plays a key role in that, though not as a big a role as we had anticipated a couple of years ago” (1Q17 Earnings Call)

…and re-emphasized meta, which I suspect was significantly responsible for the positive revenue per shopper inflection last quarter.

Monday morning quarterbacking

The process flywheel of user growth and engagement generically undergirds a great internet asset in the abstract, but the orientation of that asset towards a commercial purpose congruent with the fundamental drivers of that process, is what baselines a great business in the concrete. A terrific asset can’t just be repurposed for any ol’ thing.