[APH] Amphenol + quick $APG follow-up

Soon after I published a bullish post on APi Group last week, a few Twitter people hinted that the company might be playing games with their organic growth (as always, thank you for the pushback). I looked into this a bit and noticed the following footnote in an 8-K dated Feb. 15, 2021 announcing preliminary year-end 2020 results:

The Company’s management believes that organic net revenues growth provides a consistent basis for year-over-year comparisons in net revenues as it excludes the impacts of non-bolt-on acquisitions, completed divestitures, and changes in foreign currency impacts. (emphasis mine)

In other filings, management excludes “material” acquisitions from organic growth. I assume that management is using the words “material” and “non-bolt-on” interchangeably. This then implies that APi is including revenue from bolt-on acquisitions in their organic growth. In my opinion, no company that has done more than 90 acquisitions since 2005 and whose go-forward strategy is in large part predicated on roll-ups should be doing this.

Bolt-on acquisition revenue likely had an immaterial impact on reported organic growth over the last few years. In the 2022 10-K, APi discloses:

During 2021, the Company completed the acquisitions of Premier Fire & Security, Inc. (“Premier Fire”) and Northern Air Corporation (“NAC”), both included in the Safety Services segment, as well as several other individually immaterial acquisitions. (emphasis mine)

It looks like they paid $34mn for acquisitions other than Premier Fire and NAC. If we assume a 1x multiple, then at most $34mn of acquired revenue from 2021 acquisitions is included in the organic growth reported for that year. That’s a mere 0.10% of 2020 revenue compared to 16% organic growth in 2021. Not a big deal. But going forward how should we think about organic growth, which is unlikely to be aided by the inflationary environment of the last few years? Like let’s say APi acquires ten $10mn revenue companies. They are individually immaterial but collectively meaningful for a company that grows 7% “organically” on a ~$6.6bn revenue base.

To be clear, I’m not accusing management of malfeasance. I have no evidence of any wrongdoing. The footnotes clearly disclose that organic growth excludes only the “impacts of non-bolt-on acquisitions”. But I don’t like that this policy gives them the discretion to pick and choose which bolt-ons to include in organic growth. APi should exclude all acquired revenue. Rollups inherently lack transparency, which makes investors extra wary of anything that even whiffs of shadiness, understandably so. There must be absolutely no doubt about the integrity of a critical KPI like organic growth.

If I’ve got this wrong or am misinterpreting something, please let me know. For the most part I like what I see at APi and I want to own the stock. But man, I gotta say, this suspect organic growth disclosure has been gnawing at me over the last week.

If Constellation Software and Texas Instruments had a baby, it might look something like Amphenol. This company sells over 100k forgettable but mission critical products into wide range of systems through a decentralized collection of acquired business units. The largest player in a fragmented industry that encompasses thousands of players, Amphenol was founded in 1932, manufacturing tube sockets for RCA’s vacuum tube radios. The company IPO’ed in 1957, was acquired 10 years later by Bunker Ramo, who was in turn bought by Allied Signal in 1981. Allied then sold Amphenol for $430mn to LPL Investment, who re-IPO’ed the company in 1991. With 30% of shares under its ownership, LPL backed the $1.5bn sale of 75% of Amphenol to KKR, who reduced their stake to less 49% three years later before exiting completely in 2004.

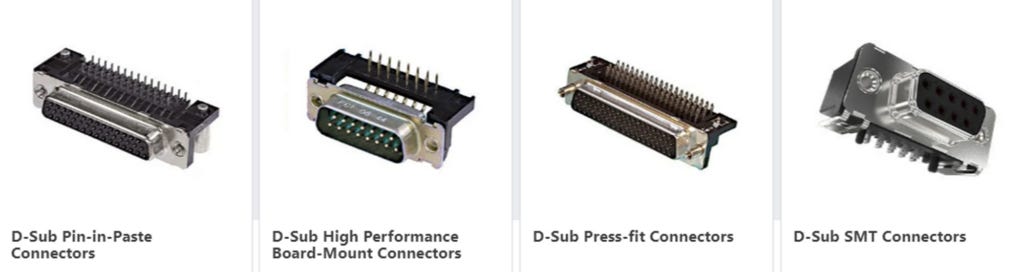

Over the course of this winding history, vacuum tubes were eventually replaced by transistors. But the spirit of Amphenol’s inaugural product – a connector that reliably transmits power and signals from one place to another – remains. What are “connectors”? You know:

Connectors, or “interconnects”, come in a wide variety of shapes and sizes, and carry abstruse technical labels, but you can basically think of them as the thingies you find at the end of electric and fiber optic cables and the ports that those thingies plug into. The CEO of TE Connectivity1, a close competitor to Amphenol, once put it:

when you think about what we do, the semiconductor is the brain of the applications we’re in. You might have a power supply that’s the heart. I say what we do are the arms and the legs to really make sure how you get the connection of the different modules and inputs together