AppFolio and the business of property management software

(Note: Several weeks ago, MBI and I recorded a podcast conversation about AppFolio. You can listen to it on Spotify, Apple, YouTube, or via this RSS feed).

While narrowly geared toward property managers today, AppFollio was founded in 2006 with the more expansive aim of providing business management software small and mid-sized businesses in general. Its horizontal orientation was plainly laid out at the time of its IPO in 2015, with the prospectus opening:

Our mission is to revolutionize the way small and medium-sized businesses grow and compete by enabling their digital transformation.

In part due to co-founder John Walker’s experience renting properties, AppFolio began its journey with property management in 2008[1]. In retrospect, it’s easy to see why property management would be a natural starting point. Like so many other SMBs, small property management firms, underserved by legacy incumbents like Yardi and RealPage who catered to the high-end of the market, were stuck tailoring horizontal solutions like Excel and QuickBooks to their needs. But rental properties also enjoy recession-resilient cash flows that convert to reliable per-unit subscription revenue (managers are typically charged a few bucks per unit managed per month) and payments processing fees to the software vendors who serve them. Those cash flows can be used to germinate other services for various constituents: the owners who waterfall cash flows to LPs, monitor mortgages, and track KPIs across properties; the managers they hire to handle rent collection and day-to-day operations need to streamline workflows, pay vendors, and keep track of rent rolls; tenants who need an efficient way to find the right apartments, complete applications, secure rental insurance, make monthly payments, and access maintenance services during their lease. With so much surface area to cover in property management alone, why even both selling software to other verticals?1

And so, AppFolio’s property management software started with the basics – keeping track of rental payments and vacancies, allocating utility costs across tenants, advertising unoccupied units across online listing sites, hosting online applications, streamlining tenant communications through mass email and text. But that core was inevitably accompanied by a growing array of value-added services (Value+), including: website hosting (2009), electronic rent payments via ACH (2010), tenant screening (2011), landlord insurance(2012), electronic rent payments via debit and credit cards (2012), contact centers for maintenance requests (2014), renter’s insurance (2017), investment management tools for property owners (2019) and a slew of AI-powered tools to manage inbound tenant interest and direct maintenance service requests. To borrow some Salesforce vernacular, AppFolio is a system of record (for keeping track of rent rolls, and tenant data), system of engagement (for interacting with owners, tenants, and vendors) or, more recently, a system of intelligence (leveraging data to, for instance, optimize rental yields or schedule maintenance requests).

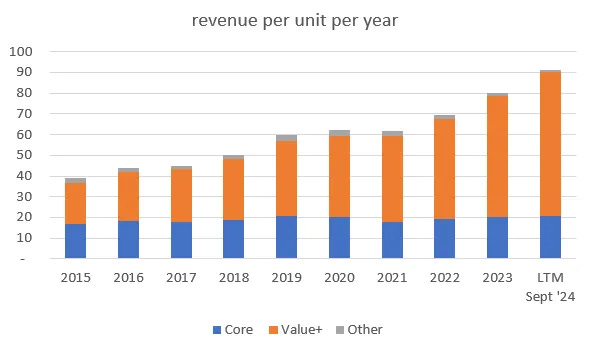

Some of these ancillary services were obtained through acquisition - Rentlinx (listing vacant units on apartment search sites), WegoWise (utility data and analytics), Dynasty Marketplace (AI solutions), LiveEasy (move-in services, including connections to utilities and internet). But for the most part, AppFolio built nearly all its products in-house. Pretty much all of its 27% annualized revenue growth since IPO has been organic and most of that organic growth, in turn, has come from Value+ revenue, which have expanded by 14%/year on a per unit basis compared to 2%/year for Core Solutions.

(”other” includes revenue from onboarding and other non-recurring services)

I figure that more than 85% of Value+ revenue comes from electronic payments processing and tenant screening. Those add-ons were among the earliest of AppFolio’s offerings and are standard features in residential rentals. Adoption is likely somewhere between 85% and 95% of AppFolio’s units.

See the big jump in Value+ rev/unit from 2022 to LTM in the above exhibit? That’s primarily the result of AppFolio reinstating fees for ACH payments ($2.49/unit/month if the resident pays, $1/unit/month if the property manager eats this cost themselves) in August ‘23. Assuming a blended rate of $2/unit/month on 90% of units gets us to about $184mn of payments revenue alone. Including fees from rent payments made via credit/debit, vendor payments, and dues owed to community associations, etc. payments processing is almost certainly AppFolio’s single largest revenue stream, well exceeding the $174mn that AppFolio generated from Core over the last 12 months. While not “a payments company that happens to sell property software” (and while we’re here, no, Dominos is not a tech company that happens to sell pizza and airlines are not card issuers that happen to fly planes), AppFolio is nevertheless a shining example of the ongoing convergence between payments and software that Global Payments and Shift4 harp on repeatedly.

All PMS vendors basically have the same the same set of solutions (accounting, payments, tenant screening, etc.). I don’t think it worthwhile to outline which particular products AppFolio has that competitors don’t and vice versa. If Yardi or AppFolio (or whoever) launches or acquires a new product that gains adoption, you can be sure that everyone else will too in short order. More interesting are the design and compatibility trade-offs that each player makes depending on the size and sophistication of the property managers they serve.