[AVLR] Avalara + another quick EVBG update

[AVLR] Avalara

Avalara makes software that businesses use to calculate sales tax and prepare returns, leveraging two key enabling elements:

The first is content. Avalara maintains a current log of sales tax requirements across myriad jurisdictions, domestic and international, and the business logic to apply the right tax rules to the right product in a given location. This can get pretty complicated. In New York, clothing and footwear sold for less than $110 are not taxable at the state level but may be taxable at the city or county level. In Connecticut, children’s diapers are taxed but adult diapers and reusable children’s diapers are not. Maine adds an extra sales tax on Maine blueberries and Quahog Clams. In some jurisdictions, a sign that is affixed to building is taxed differently than one that is attached to a pole. Most states don’t tax groceries1. Some places tax granola bars that contain chocolate differently than those that only contain fruit. New Jersey taxes yarn purchased for art projects not yarn purchase for sweaters; Texas taxes plain deodorant but not deodorant fused with antiperspirant; Twix, because it contains flour, is taxed as food while Snickers is taxed as candy2. There are also niche tax rules that apply to lodging, telecom, fuel, alcohol, and tobacco. The geographic boundaries need to be delineated just right – different tax rules could literally apply to two identical retailer across the street from one another.

A small or mid-sized business won’t have the resources to stay abreast of tax laws across 12k+ US tax jurisdictions, each with varying filing, remittance deadlines, and exemption rules. In the US, every state has a volume or sales threshold (”nexus”) at which a business is required to register and collect/remit sales tax. And outside the US, businesses must contend with Value Added Tax (VAT) and Goods and Services Tax (GST), where taxes are paid on the incremental value added to a product at every layer of the value chain, by the manufacturer who purchases the raw materials, by the wholesaler who buys from the manufacturer, by the retailer who buys from the wholesaler and by any other intermediaries along the way3. An already onerous process is exacerbated by cross-border transactions, where a business must contend with foreign languages, legislative rulings, custom duties, import taxes, and other aggravating compliance nits.

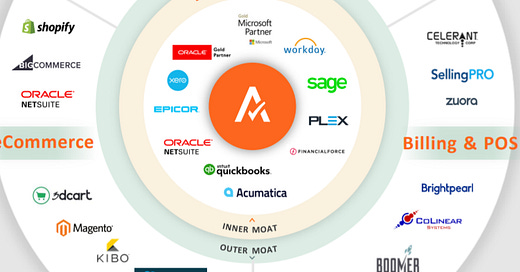

The second is integrations. Tax compliance is important but it’s not the ballast that anchors other small but important tasks that most merchants don’t even know they need to handle. No one launches a business thinking about sales tax requirements from the start. Avalara must go wherever transactions naturally land. So they’ve been very aggressively building connectors into every relevant system of record, starting with private connections into mid-market ERP systems like Netsuite, Epicor, Dynamics and Sage. Management refers to these integrations, which each take thousands of hours to build, as the “inner circle” because they aggregate transactions across the enterprise. As more commerce has shifted online, Avalara’s integrations have expanded to include marketplaces like Etsy and Amazon, as well as e-commerce platforms like Shopify, WooCommerce and BigCommerce.