[AVTR] a poor man’s Thermo Fisher

Avantor is like Thermo Fisher in some respects. It distributes lab products and sells bioprocessing tools. It, too, was built through transformative M&A. It even has an analog to PPI – the kaizen-based continuous improvement framework Thermo Fisher adopted from Danaher – in the form of the Avantor Business System. But sadly, these surface similarities haven’t yielded comparable business outcomes.

Avantor’s origin dates all the way back to 1904, when John Townsend Baker, a chemistry student at Lafayette College, launched JT Baker Chemical Company to produce chemicals of the “highest degree of purity commercially available.” I won’t bore you with the details of ancient corporate history1 (see the footnotes if you’re interested). Suffice it to say, JT Baker was hot potato’ed from one owner to the next before New Mountain finally acquired it in 2010 for $280mn and renamed it Avantor.

The chemicals-heavy business acquired by New Mountain is just a small portion of what makes up Avantor today. The more significant part comes from VWR. VWR is even more ancient than JT Baker, with origins dating back to 1852, when it was founded as a vendor of mining and lab products called John Taylor Company. Again, after some hot potato2, business transformation, and M&A, in 1999 it ended up in the hands of Merck KGaA, who then sold it in 2004 to Clayton, Dubilier & Rice, who in turn flipped it in 2007 to Madison Dearborn Partners, who then took VWR public 2014!

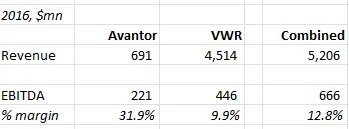

By the time Avantor acquired it in 2017 for $6.5bn (~14x pre-synergy EBITDA), in a deal that left the combined company choking on 9 turns of leverage, VWR had, through more than 50 M&A transactions over the preceding decades, established itself as the third largest supplier of lab equipment and consumables after Thermo Fisher’s Research and Safety market channel (i.e. Fisher Scientific) and Merck KGaA’s Science & Lab Solutions (better known as MilliporeSigma, the product of Merck’s Millipore and Sigma-Aldrich acquisitions)

Fish swallows whale:

The merger combined legacy Avantor’s proprietary products with VWR’s distribution, creating, in management’s words: “a leading global provider of discovery-to-delivery solutions that offer more value to customers along with an additional layer of supply chain security.”

Avantor manufactured high-purity reagents, buffers, and other chemicals used in life sciences research, biologic drug production, and yield-sensitive industrial applications like semiconductor wafer manufacturing. Through NuSil Technology, which New Mountain had previously acquired in 2011 for $735mn and later fused into Avantor, it also produced medical-grade, high-purity silicones, primarily used in medical devices, like breast implants, cochlear implants, and pacemakers.

VWR, through a logistics network spanning North America and Europe3, distributed branded and private label products – everything from glassware, pipette tips, and personal protective equipment to basic chemicals and instruments – from 4k+ suppliers to 300k+ customer sites, pitching itself as a one-stop procurement platform for R&D labs, biopharmas, and academic institutions.

In May 2019, the enlarged Avantor went public in what then CEO Michael Stubblefield described as “the largest healthcare IPO in US history”, raising $4.4bn of proceeds that went toward paying down debt and preferred equity, bringing leverage down to ~4.5x. Management then continued to demonstrate impressive discipline during the life sciences mania, sitting out the M&A craze and reducing high cost debt while competitors shelled out massive sums at indefensible multiples. Just kidding! Avantor was among the worst offenders, plowing $3.8bn4 on a trio of transactions at the 2021 peak: