[BOX – Box; DBX – Dropbox] Opportunities and competitive challenges

Dropbox and Box both originated as file sharing and sync (FSS) vendors in the mid-2000s but have since traveled along different trajectories. Box began migrating upmarket in 2008, complementing its core document storage solution with add-ons demanded by compliance-sensitive large enterprises….things like:

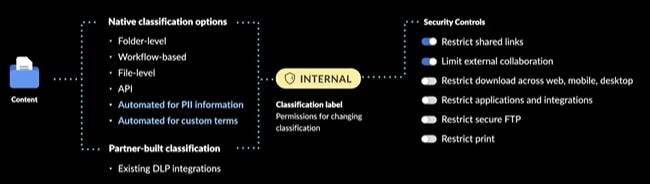

Box Shield, which prevents a user from downloading a file infected with malware, automatically assign a “confidential” or “internal only” label to documents containing sensitive client info (social security number, credit card information, passport number), and restricts file access to approved devices, applications, or users who have signed NDAs, etc.;

(Source)

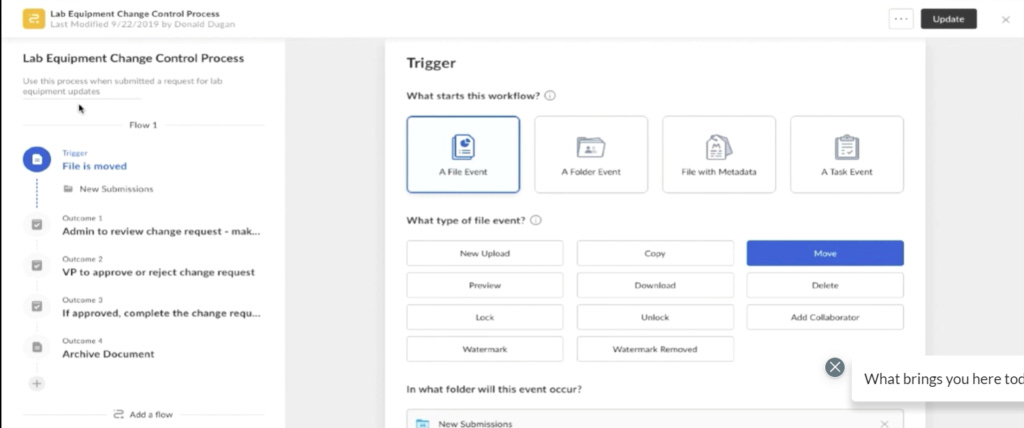

Box Relay1, which automatically triggers a workflow upon a file event…for instance, per the exhibit below, a document requesting new lab equipment is saved in the submissions folder, which pings the procurement manager for approval. Likewise, a file event related to a new employee hire might set off an onboarding workflow or a new sales contract might trigger a signature request from the VP of Sales;

(Source)

Box Governance, which administrators use to permanently delete sensitive documents after a set duration, especially useful for complying with GDPR, CCPA, and HIPAA regulations;

and

Box Keysafe, which gives customers control over their own encryption keys and provides an audit trail of who is using those keys and when.

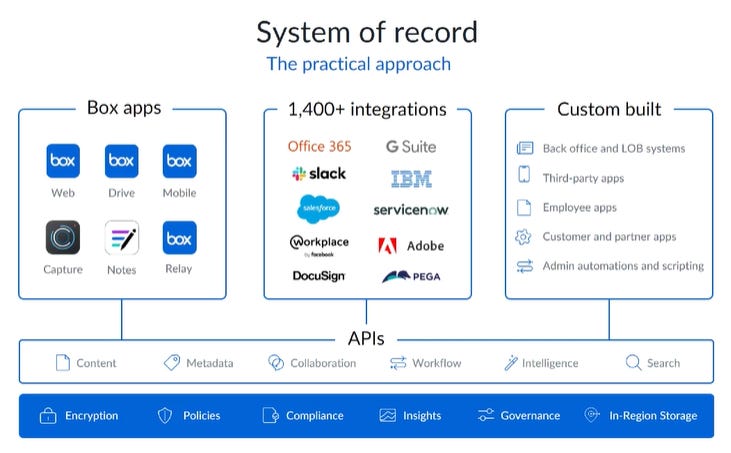

As part of Box Platform, these functions are also exposed as APIs for third-party developers. A web app might ask a customers for personal financial information and in the background that customer information might be broken up and saved across different Box folders, each event triggering a workflow, each folder accessible only to certain team members and containing only the bare minimum of personal information required for those members to do their jobs. LegalZoom uses Box Platform to enable customers to save and share sensitive legal documents with attorneys and accountants.

As Box surrounded content storage with more add-ons, it grabbed share from legacy on-premise enterprise content management vendors like FileNet (IBM), OpenText, and Documentum whose solutions could only be accessed remotely through VPN, didn’t integrate well with productivity apps, were closed to external partners, and generally geared to the important but low level task of securely storing content rather than the higher value purpose of enabling workflows. IBM actually once considered natively building out some of Box’s collaboration and security features for its proprietary FileNet content management platform but partnered with Box instead.

Whereas legacy content management systems tightly coupled clients with data repositories – such that the only way to access files in SharePoint was through a SharePoint client – Box built out a wide array of integrations that allowed users to pull Box files from Salesforce or Slack or whatever, positioning itself as a central hub for managing and securing content.

Today, Box looks something like this…

(Source)

….a system of proprietary add-ons and third-party integrations centered around content, designed to meet the stringent compliance, security, and governance demands of large enterprises.

Whereas Box sees itself as a content management utility that runs in the background, with security and compliance and automated workflows tied to document and folders, Dropbox is positioning itself as a productivity app that plays in the foreground, with team members congregating in virtual spaces to assign and complete tasks and collaborate on projects and so forth.

Whether on both Mac or Windows, the file Finder has long looked something like this…

(source)

….a repository of folders containing files with no collaborative capabilities and no integrations with third party apps. In 2019, Dropbox morphed that interface into a workspace that looks something like this:

(source)

Each folder contains a description of the project, as well as files and tasks related to it. Each file embeds a comment threat and a detailed timeline of who made edits and when.

(source)

Directly from Dropbox, you can run a Zoom meeting or send messages in Slack. The Creative Tools add-on makes it easier for creative teams to transfer large media files and comment on video/audio frames. So Dropbox emerged from the background to become a front-end engagement touchpoint for users, which makes it feel much more like a consumer app compared to Box. And compared to fast-twitch communications centered apps Teams and Slack, Dropbox is more of a sedate space for focused, organized work (or as management puts it, Slack is to Dropbox as short-term memory is to long-term memory).

Differences in product orientation have downstream consequences on the go-to-market motion. Whereas Box sells directly to enterprise CIOs and CTOs in 9-12 month sales cycles2, Dropbox takes a “product-led” approach, with 90% of its bookings self-served by individuals or small teams. Dropbox built out a direct sales force 6 or 7 years ago to also target large enterprises, but they eventually retracted. Today, ~40% of Dropbox’s registered users work at small-medium businesses with between 200 and 250 employees, 25% work at mid-market and enterprise, and the remaining 35% are “Individual” users. While 80% of users use Dropbox for work, most are still on Individual or free Basic plans.