Chewy and Zooplus

Like many online retailers, Zooplus converts incremental profits from its growing scale into growth through investments in price and Google keywords. But cutting prices is a blunt tool as it reduces profits from all existing customers, and spending 80% of your marketing budget on Google eventually hits a limit. There are no volume discounts on keyword spend:

The above plot is just an average of Zooplus’ average CAC over time and understates the marginal cost to acquire a customer, which climbed up to €50 in 2019. First year contribution margins on newly acquired customers were barely positive in 2018 and flipped negative the following year. Zooplus tried shifting ad dollars to other online and offline channels, cutting its Google spend to ~70% of the marketing budget, but found the unit economics there to be even worse.

Moreover, Zooplus is put at further disadvantage as more search traffic migrates to Amazon and more time is spent on smartphones. Zooplus’ mobile app accounts for 14% of its orders and its conversion rates and basket values there are below what they are on desktop:

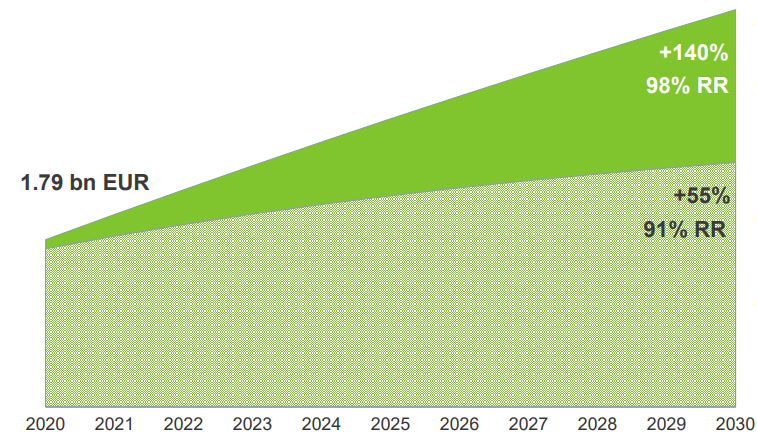

And so with CAC trending higher and traffic shifting to unfavorable channels, Zooplus is focusing less on acquiring new customers and more on milking the customers they already have. Retention is a key metric because customers who stick around transact more frequently and build bigger baskets over time. The exhibit below from last year’s Analyst Day shows that on a base of €1.8bn of LTM revenue, 98% revenue retention leads to €4.3bn of revenue by 2030 while 91% retention results in just €2.8bn1

Retention is a function of customer satisfaction which, from Zooplus’ perspective, boils down to price, convenience and selection. Amazon competes on similar terms and with a wide assortment of non-pet product offerings, it can also loss lead on pet food to drive larger, more profitable bundles and superior retention.

Where Zooplus differs is that it over-indexes on specialty products from vendors who don’t want to dilute their higher-end brands by listing on Amazon. Premium and super premium brands make up 60% of Zooplus’ sales compared to just 20% for the overall European pet food market. (specialty high-end pet food suppliers don’t like to be bundled with mass peers. Blue Buffalo, once a darling specialty brand, was roundly criticized by dog food aficionados when it began selling into Target and Wal-Mart. Several vendors pulled their upmarket brands from Chewy when Chewy started accommodating mainstream products)2.

Just 20% of Zooplus’ top 500 brands overlap with what’s on offer at Amazon direct.

Zooplus thinks that Amazon is increasingly ceding the pet food category to its Marketplace vendors, who have 80% product overlap with Zooplus but almost always charge higher prices. And compared to Amazon direct, Zooplus prices are about the same, maybe even a bit better, after applying the 3% to 5% discount that customers enjoy by enrolling in Subscribe & Save. That Zooplus generates profits even as its products are at least as favorably priced as Amazon’s suggests the specialized logistics around bulk pet food distribution may be hard for an Everything Store with a near infinite assortment of heterogenous SKUs to replicate. Optimizing fulfillment and transportation logistics means simplifying product selection: the lower the SKU count and the more common the product dimensions, the less time spend mixing and matching products from different pallets. 85% of Zooplus’ sales come from pet food, which tends to be purchased on a regular cadence that Zooplus and its suppliers can plan their logistics around.

Now, if you can’t sell dog food at competitive prices nothing else matters, but I wonder if Zooplus’ preoccupation with logistics both reflects and calcifies an orientation around cost and convenience that crowds out a more general concern for meeting customer needs. In the decade from 2005 to 2014, with sales retention3 plummeting, Zooplus mixed away from accessories toward lower margin but recurring consumables.