[FDS, LSE/Refinitiv] Market infrastructure: part 1

In the decade or so leading up to the mid-2000s, FactSet was in the business of aggregating third-party content from a variety of different vendors – financial information from Thomson Reuters; index data from MSCI, Russell, and S&P; trading data from exchanges – cleaning it up, hosting it on mainframes, and rendering it on workstations used by buy-side research analysts and portfolio managers (~80%-85% of annual subscription value) and investment banking analysts (if you worked as an investment banking analyst out of college, there’s a good chance you used FactSet to build models and comp tables).

On the back of its content business, FactSet wormed into Analytics…so in addition to running screens and looking up financial data, portfolio managers could upload their portfolios into FactSet and see how they deviated from their benchmarks in terms of factor tilts, P/E ratios, ROE, etc.; how much of their outperformance could be attributed to certain factors (momentum, value, vol); and how they might be expected to the perform under various stress scenarios1

As Analytics caught on, FactSet made smallish acquisitions to build out its first party proprietary content – earnings estimates (JCF), transcripts and events (CallStreet), news alerts (StreetAccount), and data related to equity ownership (LionShares) and M&A transactions (MergerStat). By 2010, half of its employees were in India and the Philippines, collecting data from source filings. Today most of FactSet’s data is proprietary2. More so than other content aggregators, FactSet scrubbed and normalized its datasets, ensuring that apples/apples comparisons could be made across companies, over time (back when I had access to both FactSet and Bloomberg, I’d use FactSet when the accuracy and consistency of company financials was of paramount importance and Bloomberg for just about everything else). After 2010, it also started delivering this data through feeds, directly to clients’ proprietary applications3.

Finally, with its acquisitions of Portware, CYMBA, and Vermilion in fy16 and ‘17 (ending August) – more was spent on acquisitions those 2 years than in the previous 10 – FactSet complemented its front-end solutions with automated trading and order management platform.

So what was once a workstation that bundled 3rd party content has expanded into 1st party data, feeds, analytics, order management, and trade execution. These services can be consumed separately through APIs, but the hope is that asset managers will find it more useful to standardize their entire workflow on FactSet….i.e., an analyst or PM might draw on FactSet data to research a stock and place a trade through the FactSet’s order management system, where it is checked it for compliance, executed, and ultimately reflected in FactSet’s analytics and reporting software. And all this stuff is now being repackaged and sold to wealth management firms4, where I expect FactSet will take share from Refinitiv, which has long been the industry’s basket case.

In realizing scale economies in acquiring and distributing content and then surrounding that core content business with analytics and trade/order management, FactSet has come to look more like Bloomberg and Refinitiv, the leaders in the financial data/analytics space, with 33% and 23% market share, respectively. But is that enough? Bloomberg acquired Barclays’ index benchmarking business for $781mn in 2015 and now has $725bn of ETF assets5 benchmarked against its indices. Refinitiv is about to be acquired by London Stock Exchange, owner of the FTSE Russell family of indices. Capital IQ and SNL are part of S&P Global, which has majority ownership of the joint venture that owns the IP to the S&P and Dow Jones indices.

These index businesses, which own widely adopted and effectively irreplaceable IP, provide a captive customer base for data aggregators to sell into and a channel to further productize data in the form of new indices….which, of course, leads me to wonder if FactSet might some day find itself part of a larger financial infrastructure complex, particularly as asset managers (85% of FactSet’s revenue), challenged by fee compression, consolidate their vendor relationships to realize cost savings and extract efficiencies.

But even without the insulating layer of index IP, FactSet seems to be doing pretty well. It has grown organically every year since at least 2005 (high-single digit growth most years vs. 1%-2% for the industry as a whole), including in fy09, when it eked out 1% growth in the midst of severe industry pressure that dragged its client retention rate from 92% to 87% and its user base from 40k to 37k.

FactSet’s success partly a consequence of product development and cross-selling. Over the decades, FactSet has done a fine job layering one growth opportunity atop another, with Analytics carrying the baton as Workstation growth petered out, and now CTS and Wealth Management doing the same as Analytics starts to mature.

It’s also a function of the company’s renowned service culture, which mandates that all salespeople and product developers spend 2-3 years servicing clients. I’m reminded a bit of Jack Henry, which provides core processing infrastructure for banks with less than $50bn in assets and is also celebrated for its outstanding customer service. The number of sub-$50bn commercial banks has been in decline since the 1970s, shrinking by close to 5%/year since 2012. Jack Henry’s own customer base has declined by ~2%/year during that time. And yet it continues to post high-single digit organic growth by leveraging its sticky core processing business to cross-sell other services that small/mid-sized banks and credit unions require to stay competitive with Tier 1 money centers.

I can imagine a similar dynamic playing out at FactSet, where the number of clients declines a bit every year but revenue still kind of chugs along at a mid/high single-digit pace as asset managers with the most scale survive and adopt more of FactSet’s solutions to stay cost competitive. We can already see this happening, with ASV retention stable at ~95% even as client retention has fallen from 94% to 89% over the last 4.5 years.

By geography, low single digit growth in the US has been offset by high-single digit growth in Asia and Europe, where FactSet is still early and the active-to-passive shift isn’t as pronounced. By product, flat growth in workstation users (across the industry, the terminal business is flat/declining) has been offset by high-single/low-double digit growth elsewhere.

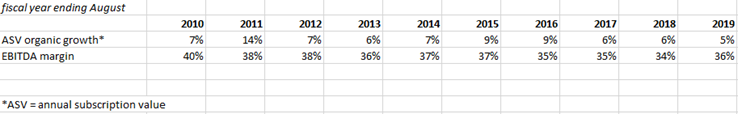

That said, it’s worth noting that even as FactSet has acquired more content and bolstered its end-to-end workflow proposition, organic growth has decelerated and EBITDA margins have declined….

….which makes me think that new content and services are less a growth accelerant and more a customer retention tool with some upselling motions that allay secular headwinds. Portfolio analytics was a natural cross-sell to equity managers already using FactSet’s data terminal, but it’ll be tougher to organically crossing into other adjacencies, which are dominated by other champions. A strong position in equity analytics doesn’t also confer advantages in multi-asset class, where Aladdin (owned by BlackRock) and RiskMetrics (acquired by MSCI) have more substantial footprints. Nor does it provide the muscle to claim significant share in trade execution and order management systems from Bloomberg, the largest player with 38% share.

Of course, absent FactSet’s superior customer service and focused execution, things could be much worse.

Just ask Thomson Reuters.