[FISV, GPN, FIS, SQ, Stripe, Adyen] On payment processors, distribution, and technology: Part 3 of 4

Having covered merchant acquirers and card networks, I’m down to the final part of the payment edifice – issuer processors. Issuer processors are to card issuing banks what merchant acquirers are to merchants. They authorize and process transactions on behalf of card issuing banks under long-term agreements and recognize revenue based on a combination of transactions, cards on file, and licenses. Like merchant acquirers, issuer processors have countered the commodification of transaction processing by layering on services like analytics, fraud detection, and customer service (call centers). So today a bank might rely on its issuer processor to sort through transaction data to detect fraud patterns, increase credit limits, or market credit offers to certain cardholders. There are various point providers out there, but large financial institutions prefer buying from large sophisticated vendors like Total Systems and First Data (the first and second largest issuer processors in the US) that can bundle all these solutions and surround them with information security and compliance standards. It’s easier and safer.

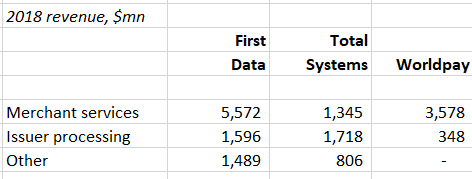

In the prior two posts, I only addressed the merchant acquiring businesses of First Data, Worldpay, and Total Systems. But all three companies have other revenue streams:

Issuer processing is Total Systems’ largest business. It is a forgettable part of Worldpay and doesn’t exist for Global Payments. For First Data, the “Other” segment refers to fees earned from STAR (a US debit payment network that competes with Visa and Mastercard the same way a minnow competes with sharks) and debit card processing. For Total Systems, it refers mostly to prepaid cards1 (these are cards that unbanked consumers can load with cash – online or through any one of ~90k retail locations (7-11, Kroger, Walgreens, CVS, Dollar General, Family Dollar) – and use like debit cards). This used to be a hot business for Total Systems, but not so much anymore. Revenue growth has decelerated from 20% in 2015 to 8% in 2018 and operating margins have gone nowhere during that time. In an attempt to get consumers to think about Netspend as an account that can be regularly drawn upon to pay for things as opposed to an undifferentiated disposable SKU, management has been purusing distribution agreements with employers and payroll processors like Paychex, who can directly deposit wages to these cards.

A separate but related part of the payments plumbing is what’s known as account processing, or core processing. A core processor is a book-keeping system that banks use to record transactions, reconcile those transactions with account balances, and ensure all changes in account balances are reflected in the bank’s general ledger. Rather than develop the expertise to build and maintain these complicated back-end systems themselves, banks (especially small banks) will typically outsource to a specialized scale provider like Fiserv (FISV) or Fidelity (FIS).

Core processing is a mission critical service that banks rely on to operate day-to-day. The combination of customer stickiness (high 90s renewal rates, excluding clients lost to acquisitions) and long-term contracts (3 to 5 years in length) renders core processors recession resilient. In 2009, a period of punctuated uncertainty for US banks, organic revenue declined by just 1%2 for Fiserv, and was roughly flat for FIS and Jack Henry. Nearly all core processing contracts come embedded with CPI escalators. But these escalators mostly serve to offset price compression during renewals, which begs the question why, if core processing relationships are so hard to replace, must vendors compete on price? The way I see it, it is not so much that banks will choose a different core processor if the incumbent doesn’t yield a few points on renewal, it’s that they may be more reluctant to source ancillary products from the core processor going forward. Starting price concessions are small compared to the incremental wallet share to be gained.