[FISV, GPN, FIS, SQ, Stripe, Adyen] On payment processors, distribution, and technology: Part 1 of 4

This is Part 1 of what I expect will be a 3-part series on merchant acquirers and issuer-side payment processors [edit: 4-part series!]. It describes the basic mechanics of the merchant acquisition model and delves into how incumbent players like First Data, Global Payments, and Worldpay got to where they were prior the flurry of megamerger announcements earlier this year. Part 2 will mostly talk about how these companies are competitively positioned relative to each other and newcomers like Adyen, Square, and Stripe. Part 3 will address issuer-side processing. There will be significant content spillover from one part into the next.

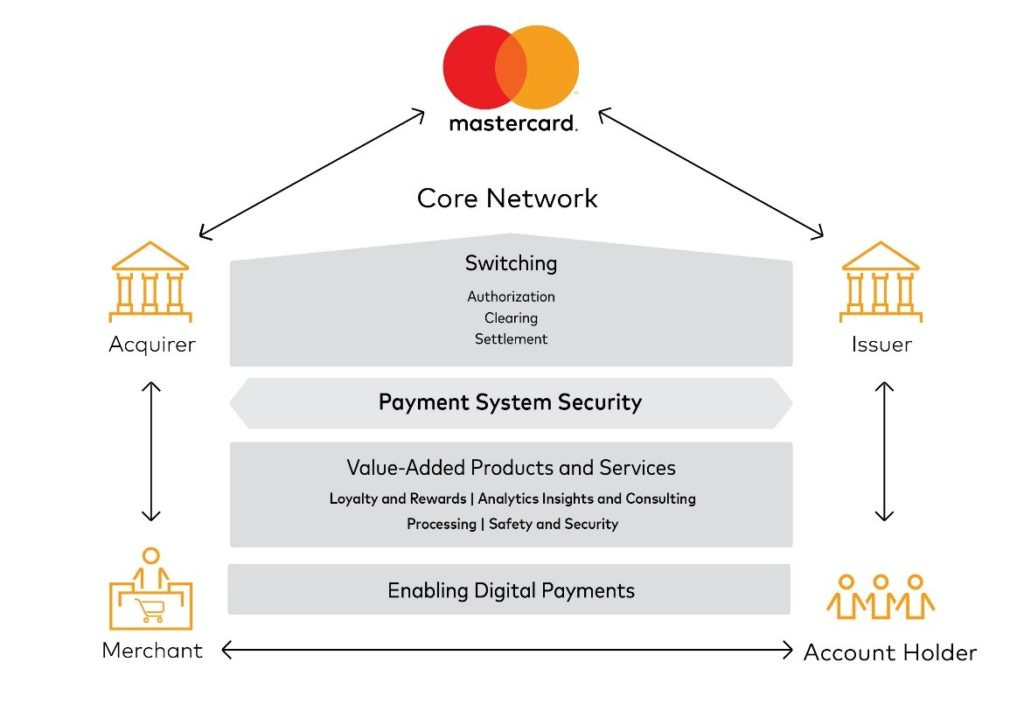

In its 10Ks, Mastercard includes a diagram that succinctly illustrates the flow of money in an electronic retail transaction:

Issuers issue credit and debit cards to shoppers. A shopper inserts her card into a point-of-sale terminal that collects card and transaction details. Those details are transmitted through from the terminal to the merchant acquirer processor, who applies a series of security checks to validate that the cardholder is who she claims to be before then routing the payment details to the appropriate payment network (Visa, Mastercard, Amex, STAR, etc.). The payment network sends that information to the card issuing bank, who validates the cardholder’s identity, runs a compliance check on the cardholder (i.e., is the account in good standing? does the shopper have sufficient funds in her account? will this transaction push the cardholder above her credit limit?) and, assuming all’s good, sends a message back through the payment network authorizing the merchant to accept the payment. Within 2-3 days of the purchase transaction, the issuer sends payment to the card network, which passes the funds to the acquiring bank, who credits the merchant’s account (“settlement”). Data flows from the merchant to the issuer for authorization; money flows from the issuer to the merchant for clearing and settlement.

[Merchants who accept online payments (aka, “card-not-present” payments) require a software application called a payment gateway that functions as the interface between the merchant’s website and its payment processing backend. You can think of the gateway as the online version of a point-of-sale terminal. It encrypts sensitive credit card info and authorizes the transaction. The processor, by comparison, transmits information to the merchant acquirer and card networks.]

A $100 transaction might net to $97.70 for the merchant, with the $2.30 merchant discount rate (MDR) divided among the issuer, card network, and merchant acquirer/processor like so:

Around 70% of the MDR goes to the card issuer as interchange fees. Card networks, though sometimes vilified as extortionary middlemen, claim the smallest portion, just 10%. The merchant acquirer processor (Heartland Payment Systems in the above exhibit) accounts for the remaining 20%. The acquirer’s fee1 flexes lower as volumes grow, blending to anywhere between $0.20 for Adyen, who acquires on behalf of large enterprises (and Adyen actually prices above others), to $0.50 (0.5% of the transaction value) for Heartland Payments, who serves small/mid-sized businesses. The disparity in take rates between the largest and smallest merchants reflects the fact that large merchants are less costly to serve as the fixed costs of service are spread over vastly more transactions.