[FLT – FleetCor; WEX – WEX Inc.] Beyond fuel to B2B payments: part 2

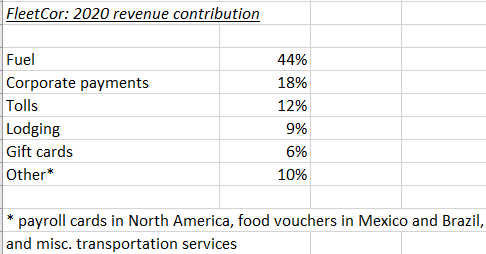

I left Part 1 noting that even as FleetCor insists on its relevance in a world of electric vehicles, it has diversified away from fuel cards, investing first in adjacent verticals like Tolls and now in more far off areas like account payables.

Through its $1.2bn acquisition of STP in 2016, FleetCor has come to process 90% of electronic tolls (and 60% of all tolls) in Brazil. It paid 9x EBITDA for an 85%+ subscription-based business expected to grow low-teens for the foreseeable future. You can think of STP as EZ-Pass on steroids, with reflexive adoption between drivers and toll booth operators now being extended to adjacent areas like gas stations (600 today, with plans to get to 5,000 in 3 years), parking lots, and even Fast Food Drive Thrus (it’s easier for a driver to handle tolls, gas, and parking on a single sticker than have a separate one for each function). These non-toll sources of interchange revenue now make up a growing ~15% of the Toll segment’s total. STP grew 15% in 2015, a year when Brazil’s GDP contracted by nearly 4% and was the most resilient of FleetCor’s businesses during COVID, growing by low/mid single digits while everything else declined.

FleetCor also sort of participates in the Travel sector through its Lodging segment, which began as a way to connect fleet operators with discounts at hotels via the fuel card program, but through its acquisition of Travelliance late last year, has since expanded to include airline crews and disrupted passengers. As you might imagine, exposures to air travel and construction wreaked havoc on over the last year, with segment revenue declining ~30% y/y.

WEX too has stretched itself beyond fuel over the last decade.

It got into healthcare in 2014, through its $533mn acquisition of Evolution One, which it provided: a) the payment processing and bookkeeping system that banks, third-party administrators, and other health plans use to process payments from Health Savings Accounts and Flexible Savings Accounts (rising healthcare costs are driving demand for HSA accounts that allow consumers to use untaxed dollars to pay for deductibles and copays) and b) the technology behind the interface that consumers use to check their account balances and the expense eligibility of certain items.

For example, when a consumer uses a prepaid debit card linked to an HSA account to cover co-pays and prescription drugs or whatever, Wex Health will validate that the item is a healthcare expenditure and process the payment. Basically, Wex is the guy behind the guy, providing the payments technology for HSA administrators and making money on interchange and subscription fees. These engagements are preceded by long sales cycles and year-long implementations and are very difficult to replace. Today, WEX provides the back-end technology for 9 of the top 20 HSA providers and its opportunity set continues to widen as more financial institutions and insurers enter the space. And through its acquisition of Discovery Benefits, a former client, Wex is also migrating up the stack, becoming an HSA administrator itself.

So…my hunch is that fuel business for both FleetCor and WEX is going to be a low growth, high margin cash cow for a long time. Electric vehicles are a possible existential threat but one that I think will materialize gradually due to the size of IC fleet base. Meanwhile, the competitive threat from modern control cards issued by Stripe, Marqeta, etc. is mitigated by: 1/ long-term white labeling agreements that WEX has with large fleet lessors; and 2/ a slew of other fuel-specific and non-control features that fleet operators value, like fuel discounts, roadside assistance, savings on tires and maintenance, restrictions on not just the amount spent on fuel but also the number of fueling trips and fuel types (diesel vs. gasoline), and intelligence on how much fueled is pumped by which driver, for which truck. FleetCor’s Toll business in Brazil looks excellent, with network effects and a long growth runway, and Lodging is a logical adjacency to fuel cards. The Gift segment, which FleetCor picked up through its Comdata acquisition, sells stored value cards through retailers and looks to be in decline, but it’s too small to matter. In healthcare, WEX has earned a reputation as a reliable back-end for consumer-direct healthcare accounts, which continue to gain popularity among Americans wrestling with rising deductibles and out-of-pocket expenses.

These businesses boast 90%+ retention rates, recurring revenue, and healthy profit margins, all conducive to supporting the 2x-5x leverage that they typically run as they go through the cycle of levering up to acquire and then de-levering1. When FleetCor buys a company, it sets out to double profits within 3 to 4 years by reinvesting the savings from overlapping IT and administrative cost cuts into a salesforce that has often been starched under its previous private equity owners2. This formula has worked out pretty well, with FleetCor’s pre-tax return incremental returns on gross capital in the 8 years leading up to 2019 coming in at around 17% (and more like 12% in the 8 years though COVID-depressed 2020)3. WEX doesn’t take the same plug-and-play approach to acquisitions, tending toward chunkier deals that bring immediate scale, but has nonetheless produced similar high-teens incremental returns.