Is Gartner Doomed?

MBI and I recorded an episode of Never Sell recently (Lululemon, Align, LLMs and Newsletters, Portfolio Holdings, Right for the Right Reasons) (Spotify, Apple, YouTube, RSS feed)

In simple terms what Gartner does is it furnishes research reports that executives use to inform consequential procurement and strategy decisions. Where Gartner wields the most influence is in IT (literally, the company’s ticker symbol!), where its insights might be used by CIOs to, say, design a cybersecurity framework, validate vendor choices, and benchmark deal proposals. After three decades focused exclusively on technology, Gartner broadened its scope to include supply chain management in 2009, then began catering to CMOs and marketing professionals in 2012 before finally, with the $3.3bn acquisition of CEB in 2017, extending its reach into HR, finance, sales, and legal. Just as it does in Global Technology Solutions (GTS) – the core IT research arm of the house – through Global Business Solutions (GBS), Gartner sells a broad array of data, benchmarks, surveys, editorial content, and expert guidance to non-IT clients, who account for ~23% of Gartner’s contract value (or CV, the annualized value of all subscription-related contracts, ~85% of which bleeds into revenue over the next twelve months).

Beyond the Insight segment, where GTS and GBS are housed, Gartner also runs conferences, which are monetized through vendor sponsorships and ticket sales to clients, and does some consulting, where it offers strategic guidance on project-level work and leverages market intelligence and deal data to help CIOs negotiate more effectively with major technology vendors1. Conferences and Consulting are complements to the Insight segment and account for just 12% of contribution profits, so I won’t be spending much time here.

Most of Gartner’s research is sold as individual subscriptions, 70% of which under multi-year terms, with an average duration of 1.7 years. The entry-level, “read-only”, tier gives clients access to reports and templates, and runs about $20k-$25k per year per user. The second, the more common “adviser-level” service, has everything the entry-level tier does but also grants subscribers unlimited 30 to 45 minute calls with Gartner’s analysts, and costs about twice as much. The highest tier, priced at between $80k and $100k, then also provides dedicated access to senior level practitioner, typically a former CIO or CFO2.

Like insurance, research is sold, not bought, and few sell it better than Gartner. Gartner’s systematic investments in sales is among the chief reasons the firm has so thoroughly outpaced its much smaller research rival, Forrester, whose 4% research revenue growth and ~10% average EBITDA margins over past decade pales in comparison to Gartner’s ~11.5% organic research growth and ~19% margins. Its reps forage enterprise territory like truffle hogs, sniffing out any job title that whiffs of spending authority – the Chief HR Officer, the Director of Talent Acquisition, the Deputy General Counsel, the Director of Compliance, the Head of Product Marketing, the Security Operations Manager, the Director of Digital Strategy. Underperforming sales reps are ruthlessly culled; outperformers are richly rewarded. A rep’s commission, typically ~40% of total comp, is tied to net contract growth within their geographic territory and has no cap.

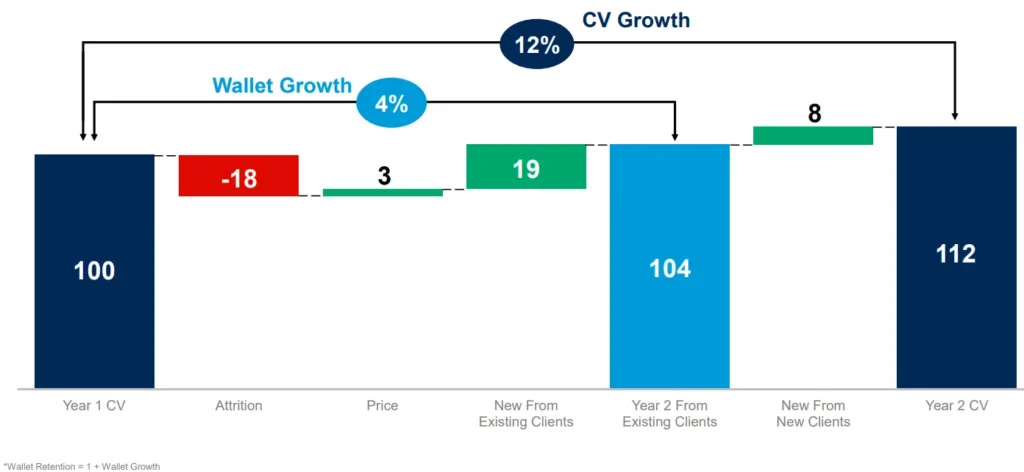

You’d think quality of data and analysis would carry the day. But sales is at least as important because customer spend, taken as a whole, tends not to stick as well as you’d think. This is not a sleepy business whose subscribers unflinchingly auto-renew year after year. For every $100 of contract value that Gartner secures today, $18 will churn off by year end. Some of that is offset by price ($3). But getting back to even and growing from there is chiefly a function of selling more products to existing clients ($19) and onboarding new ones ($8), both of which require putting ever more feet on the street and graduating new salespeople up to mature levels of productivity over several years.

Source: Gartner at William Blair (June 2024)

Eighteen percent gross dollar churn is an aggregate figure that reflects lower retention among SME’s, which make up ~25% of contract value (including small tech vendors, accounting for ~5%-6% of total CV, who only retain in the low/mid-70s), and 90%+ retention among top quintile customers. Even so, that Gartner has managed to grow contract value by double-digits nearly every year over two decades while starting each CV anniversary ~18% in the hole is testament not to the inherent retentive properties of subscription research but to the effectiveness of its sales organization.

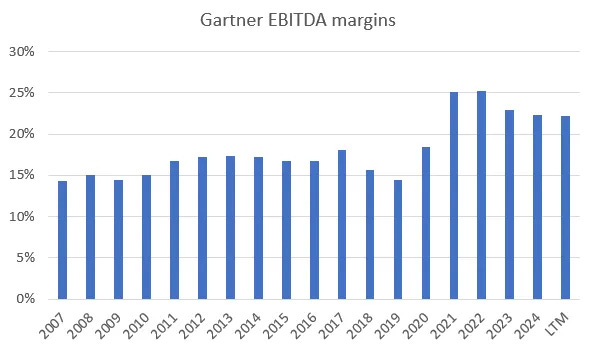

For most of the last fifteen years, Gartner deliberately managed EBITDA margins to the high-teens. It could have done better by curbing headcount additions, which would have mixed the salesforce toward more mature and productive contributors. Instead, the company chose growth and expanded its reps by around the same mid-teens rate as its contract value. With capex running at a miniscule 2% of revenue and clients paying for subscriptions ahead of consumption, around 70% to 90% of EBITDA dropped down to free cash flow most years.

Profitability dipped from 2017 to 2019 as Gartner invested upfront in advisors and sales to support new GBS products following the CEB acquisition (Gartner for HR Leaders, Gartner for Finance Leaders), then rebounded to new highs as some of the cost savings from the COVID years stuck around. Management guided for profitability to remain structurally higher as it re-tuned the growth algorithm such that, over the “medium term”, contract value growth across both GBS and GTS of 12% to 16% would outpace quota-bearing headcount growth of 8% to 12%, with the difference between the two plugged by price hikes.

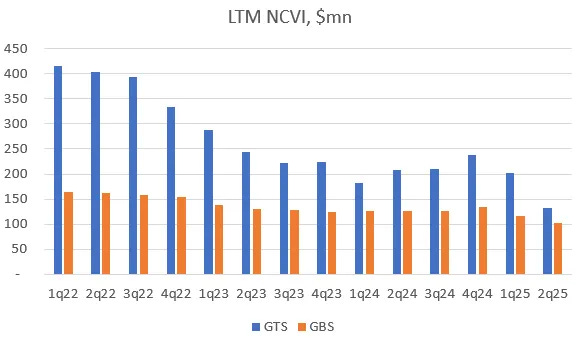

But just as the worst of COVID passed and Gartner regained its footing, the output of headcount growth, productivity gains, and pricing no longer appeared as assured or predictable. As 2022 progressed, Net Contract Value Increase (the dollar change in the contract value of subscription-related research products) declined dramatically:

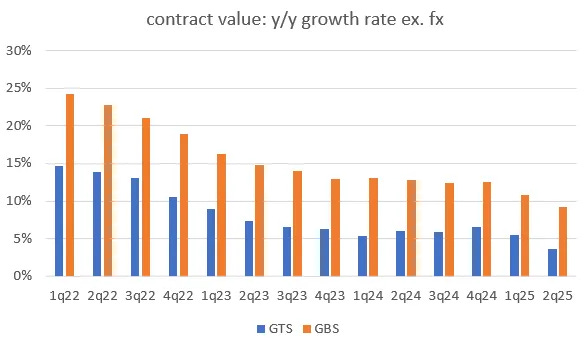

CV growth decelerated from 17% to 5% in just over three years, with the slowdown more pronounced in GTS:

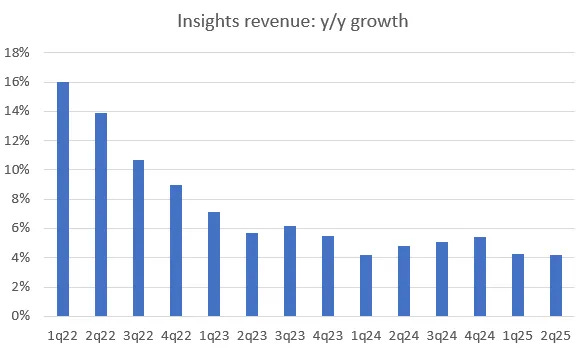

Insights revenue growth depleted in turn, from 16% y/y growth in 1q22 to just 4% in 2q25:

Gartner’s stock, which had been perched at ~40x earnings at its peak just 2-3 years ago, has collapsed to 22x trailing earnings today.