[JHX] Will James Hardie’s big acquisition pay off?

In last summer’s building materials series, I explained how branded manufacturers, like James Hardie in siding and Trex in composite decking, are protected by significant moats in the form of trusted relationships they’ve secured downstream with dealers and contractors, as well as the brand equity they’ve cultivated with homeowners:

Homeowner mindshare is a relevant consideration. Specialty manufacturers will invest in advertising to develop brand awareness and showcase the aesthetic merits of their products on TV and social media. James Hardie has become synonymous with fiber cement siding to such an extent that installers often refer to fiber cement panels as “Hardie boards”….

Sometimes consumers looking to remodel their homes will ask for SmartSide or James Hardie by name; but most of the time they will go with the recommendation of installers, who will push SmartSide or James Hardie because those manufacturers carry a well-earned reputation for quality products; offer a wide array of textures and colors; can be installed by contractors, whose single largest cost is labor, with relative ease; and are amply supplied by local dealers. Rebate programs, tiered by volume, nudge dealers and contractors to orient their efforts around a single brand. In short, branded siding products are vice-gripped into place by the pull of homeowners and the push of contractors and dealers, making them difficult for a competitor to dislodge absent meaningful improvements in cost, appearance, and durability.

Owing to consistent pricing power, fat margins, and high returns on capital, branded manufacturers tend to trade at lofty multiples. So when James Hardie, a 135-year old near-monopolist in fiber cement siding, cratered by nearly 40% this year to less than 20x earnings it caught my attention.

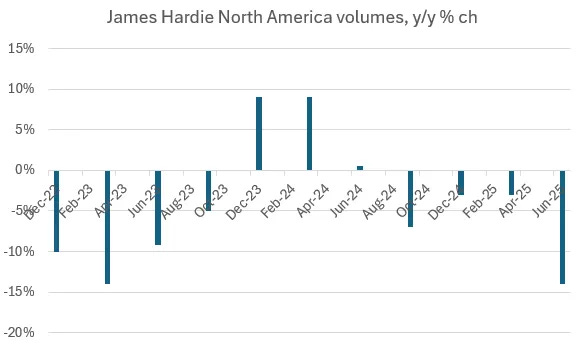

What happened? Well, first, management’s demand predictions proved wildly off the mark. After contracting for most of 2023, as repair & remodel demand weakened in a rising rate environment, James Hardie’s volumes in North America (70% of total) briefly recovered, flipping positive for a few quarters before turning flat and finally shrinking again in the three months ending September ‘24:

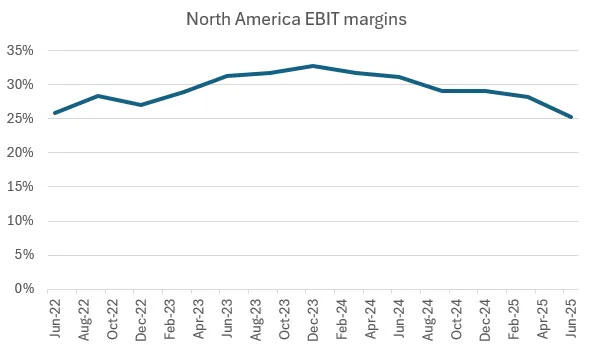

At the same time, James Hardie faced raw material headwinds, particularly from inflating pulp and cement costs, which were only partly offset through pricing and operating efficiencies. Management expected volume and margin pressures to be short-lived and planned its capex, marketing, and hiring in anticipation of revenue and EBITDA growth in fiscal 2026 (ending March 2026), even as it made minor “clutch” adjustments to capacity in response to the weaker environment directly in front of them. As analysts began to question management’s rosy assumptions and evidence of end market weakness continued to mount, with large ticket R&R activity hit its fourth year of decline, James Hardie remained undeterred, maintaining its guidance of low-single digit sales growth in fy26.

Those hopes were dashed last quarter, when North American volumes swooned by 14%, and management was forced to finally acknowledge a point that I suppose seemed obvious to some but remained unspoken – that much of the better-than-expected demand in prior periods was pulled forward by customers who expected better times ahead and wanted to get in front of Hardie’s pending price hikes. As economic uncertainty deepened in April and May ‘25, then intensified in June and July, homeowners delayed large-ticket remodeling projects and single family housing construction slumped to 2.5-year lows1. James Hardie’s customers grew increasingly cautious and destocked inventories they had built overbuilt in anticipation of a recovery that showed no signs of materializing.

With volumes contracting against a largely fixed cost base and depreciation climbing as new capacity came online, North American EBIT margins surrendered all the gains accrued over the prior two years:

Alongside mistaken macro prognostications, management also announced a huge, expensive acquisition in March, agreeing to pay $8.4bn for Azek, the #2 seller of composite decking after Trex, with ~30% market share, best known for its flagship TimberTech brand. James Hardie funded the transaction with cash (~47%) and stock (~53%), leaving Azek shareholders with 26% of the combined company. It offered a full 22x trailing EBITDA when its own stock was trading just under 13x (including asbestos liabilities), and presumably did so under the assumption that R&R spend was on the path to recovery when, as we now know, it was further deteriorating.