[MKTX, TW] Market infrastructure: part 3

During the mid/late-90s, electronic trading networks eSpeed (acquired by NASDAQ) and BrokerTec (acquired by NEX, which was then acquired by CME) rolled out central order limit booking (CLOB)1 for the inter-dealer trading of US Treasuries. Today, more than 80% of dealer-to-dealer Treasury volumes are electronic, the overwhelming majority of which is executed via CLOB2.

The dealer-to-client (institutional) part of the Treasury market has been slower to evolve. Only 40% of volumes are electronic and most of that is still intermediated through Request-for-Quote (RFQ), a protocol that Tradeweb pioneered for the electronic Treasury market in 1999 where users query market makers for prices on particular order sizes. RFQ remains the dominant way institutional investors trade US Treasuries3, despite the emergence of several other key protocols, including:

direct streaming – which has grown from nothing to over 8% of US electronic trading volumes over the last 6 years – where dealers continuously send the prices and sizes at which they will buy/sell, with bids and offers tailored to particular customer relationships;

session-based trading, where trading in certain securities is concentrated within certain time windows to improve liquidity, allowing dealers to dump their off-the-run Treasuries;

and all-to-all trading, where investors can directly and anonymously trade with each other instead of through broker-dealers.

Tradeweb has ~40% of electronic portion of the institutional Treasury market, with the other ~60% claimed by Bloomberg, from whom it has been taking share recently. On the dealer-to-dealer side, Tradeweb’s high-teens electronic share is a distant second to BrokerTec, who commands 55% of flows (down from over 80% just 4-5 years ago).

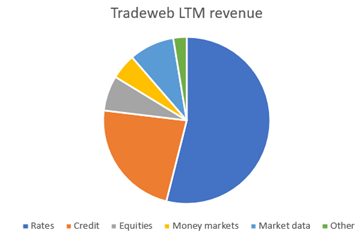

US Treasuries is the oldest and largest component of Tradeweb’s “Rates” business, which also consists of swaps, mortgages, and Eurobonds. The degree of electronification varies widely by sub-category – ~60% of total volumes in US treasuries (up from 13% in 2001), 5% in mortgages, and 20%-25% in swaps.

Outside of Rates, Tradeweb has a presence in the several other asset classes, most notably high-grade corporate debt, where it uses its strong position in US Treasuries to “auto-spot” customers’ high-grade credit trades….so an investor who wants to isolate exposure to a bond’s credit risk might buy one bond from Dealer X and sell another bond to Dealer Y and Dealers X and Y would respectively sell and buy some amount of Treasuries to hedge out the interest rate risk on the bond she sold/(bought), the cost of hedging each leg passed onto the investor. With auto-spotting, Tradeweb compresses the Treasury position on both sides of the trade down to a single net position, dramatically reducing the cost of hedging. Moreover, net spotting is executed much faster and with less error than the traditional way of separately calling dealers for quotes4.

Auto spotting is a neat wedge into the credit market. To minimize costs, the dealer must line the corporate bonds up against US Treasuries of ~equivalent duration as quickly as possible. Tradeweb’s Treasury volumes far exceed its IG Corporates volumes, so any credit spread trader on its platform can readily find a Treasury instrument on the other side. This would be hard to do on MarketAxess, whose volumes heavily skew towards corporates5. By exploiting the link between Treasuries and corporate bonds – In 2019, net spotting comprised ~1/4 of Tradeweb’s high grade trading – Tradeweb has built a meaningful credit business in a short period of time, its share of high-grade TRACE volumes doubling from less than 4% to around 8% over the last 2 years.6