[SHOP – Shopify; WIX – Wix] Platforms, scale economies, and technology

Related posts:

[Wix – Wix.com] Scaling profitably (November 2017)

[GDDY – GoDaddy; VRSN – Verisign; EIGI – Endurance International] Value Migration in Web Services (May 2018)

When I started looking into Wix more than two years ago, its capabilities seemed far beyond those of Weebly, Square Space, and several other competing site builders I was researching at the time. It had recently rolled out this feature called Artificial Design Intelligence (ADI) that, with a few pieces of information, could build a site for you in minutes. Whereas other builders offered generic themes, Wix provided pre-designed frameworks with relevant integrations for specific verticals. The company has since built on its technology leadership to become a natural integration point for other applications that a small business might need, up-selling chat, email marketing, search optimization, forms, payments intermediation, and various other productivity and CRM tools, just like a bottom up enterprise SaaS.

And as often happens with enterprise software companies, it has been moving upmarket. Wix’s DIY website builder was a “good enough” solution for entrepreneurs who might otherwise hire a professional agency. Well now, Wix is creating a toolset for the very professionals that it was previously disrupting. In late 2018, Wix launched Wix Code (since renamed Corvid), a web development environment for coders to extend features and build advanced web apps. Getting agencies and developers to standardize on its development platform would be a big deal since the addressable market of sites built by professionals is apparently 10x larger than sites developed by do-it-yourselfers1. Moreover, pros carry better unit economics, as they can be acquired at a similar CAC to DIY and they retain significantly better.

Wix’s superior technology has long been its critical value driver, as superior technology means easier and faster site creation and thus, better conversion (a higher proportion of registered users convert into paying subs); better conversion, in turn, translates to faster payback on marketing spend and more money that can be recycled back into technology2. The combination of improving conversion and product stickiness has yielded larger paid cohorts with every passing year, cohorts that exhibit remarkably consistent and stable decay patterns. The company’s earliest disclosed cohort, from 1q10, still has about the same number of paying subs 8 years later. Moreover, Wix’s product suite has expanded dramatically over that time, so I’d bet we’d see expanding cohort revenue wedges if Wix ever chose to disclose this like every other SaaS company (perhaps the fact that management doesn’t should concern us?).

Besides upselling products and targeting higher value customers, Wix is showing its maturity in two other ways. First, it now has hundreds of people in call centers proactively reaching out to customers. GoDaddy, a more mature competitor who has always been good at this, frames customer support as a revenue opportunity rather than just as a cost center. Wix is approaching customer support with the same topline generating ambition, estimating that upselling and conversion efforts there will contribute 5 points to bookings (“collections”) growth in 2020 (collections grew by an estimated 26% in 2019).

Second, it is extracting more value through pricing.

In late 2018, Wix removed its lowest priced package and pushed through a slight price increase, before then jacking up prices by 20% in May 2019.

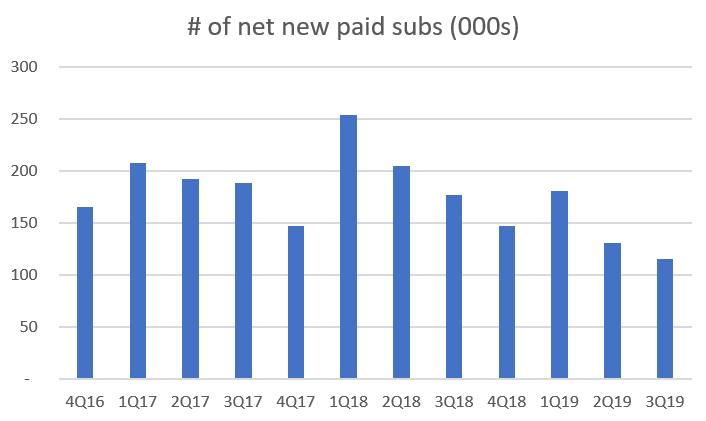

Net paid subscriber adds went like this:

You’ll notice in the cohort chart below that for the first time in a decade, the starting number of paid subscribers in the latest cohort (1q19) did not exceed, and actually fell below, the number of paid subs from the prior year’s cohort (though, retention held strong, as management made sure to highlight in the exhibit).

Average collections per sub went like that:

Not all of this per capital improvement is due to pricing. A lot of it also comes from greater adoption of ancillary services and higher priced, vertical-specific business packages.

“That” more than offset “this”, birthing a new cohort that is monetizing faster than previous ones:

But it’s worth flagging that the cumulative cash collected from this latest cohort is not much greater than it was a year ago. And meanwhile, Wix’s cost per paid subscriber acquisition has been climbing. Management claims that collections are still recouping customer acquisition costs within the same 7-to-9 month timeframe. But I’m having a hard time seeing that. The company spent $55mn acquiring the 1q19 cohort, which has so far generated $45mn of cash collections (82% of the $55mn subscriber acquisition cost). Meanwhile, Wix spent $44mn on the 1q18 cohort, which in the first 3 quarters generated cash collections of $41mn (93%). Now, in neither case was SAC recouped in 7 to 9 months and I’m sure there are timing issues that explain this, but what does seem clear is that CAC recovery speed has deteriorated from a year ago despite substantially more average collections per sub.