Square / PayPal: Part 2

Digital wallets beg to break free from the commerce platforms that nurture them. In 2002, a $20bn eBay acquired PayPal for $1.5bn. Nearly 20 years later, a $200bn+ PayPal commands 5x eBay’s market cap. The core value prop hasn’t changed much over this time. Consumers still use PayPal to manage all their payment options through a single wallet and buy things on the internet with fewer clicks. Merchants use PayPal to drive more transactions. Both buyers and sellers depend on PayPal to provide stronger protections and faster resolution than most card issuers and digital wallets can1. Its command of online checkout has proven tough to dislodge, even by card networks with direct issuer relationships. You may recall that several years ago, Visa, Mastercard, Amex and Discover all rolled out competing “one touch” checkout buttons. All these programs flopped and the SRC initiative succeeding them, where the major card networks merged their separate checkout efforts into one button, hasn’t gotten anywhere either. Nor have the wallets and checkout alternatives that have emerged over the last 5 to 10 years – Apple Pay, Google Pay, Samsung Pay, Amazon Pay, Shop Pay, Stripe – seem to have diminished PayPal’s TPV growth or transaction margins.

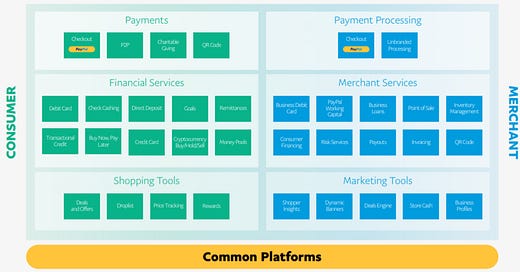

But PayPal isn’t just about payments anymore. Consumers can obtain loans, send remittances and debit cards, as well as buy and sell mainstream cryptocurrencies. Merchants can access working capital loans, point of sale systems (iZettle), marketing (Honey), business credit cards, invoicing, and other back office functions. Through its Commerce Platform, PayPal provides the technology and services used to run its own two-sided network – compliance, payments, chargebacks, fraud protection, merchant onboarding, inventory management, reporting, analytics – to other marketplaces and merchants. They are now looking to offer a service that helps manage refunds and returns. Like every other payment platform with massive scale, PayPal is rolling out online and in-store products whose “end to end” experience mirrors the fusion of offline and online retail so that, for instance, out-of-stock in-store items can be automatically shipped to shoppers’ homes and shoppers can return online items to physical stores. Or so when that shopper purchases a pair of shoes in-store using the same credit card she used online, the store manager can see the latter purchases and cross-sell related items.

A few years ago, PayPal claimed that they could grow transaction volumes another 5x+ without signing up another new merchant, simply by growing share of existing merchant transactions and consumer wallet. The key to that is offering more and more value on each side of the network, becoming the default source of payments and financial services for consumers and merchants. I think it was Reid Hoffman who defined scale as the number of people that use a product multiplied by depth of engagement. The more products PayPal provides up and down each side of the network, the more consumers engage with the app and the more transactions they get. Transactions per active account have gone from 37 in 2018 to 44 over the last 12 months. Those volumes not only leverage PayPal’s considerable fixed costs but supply data to better identify fraud, underwrite credit risk2, authorize transactions, and automate customer service.