[TECH] Bio-Techne: Part 2

Hi everyone, some things:

1) Episode 3 of the Never Sell podcast (a monthly investment conversation between MBI and me) dropped yesterday (Spotify, YouTube). In it, MBI describes some useful research tools and we explore the strengths, weaknesses, and implications of Deep Research

2) Reports will now have an audio version embedded. For Substack subscribers, the recording will appear below the paywall.

3) Upcoming write-ups: a deep dive on Charles River (CRL) and updates on Shift4 (FOUR) and maybe Visa/Mastercard. I'm not yet sure of the order in which I will publish these

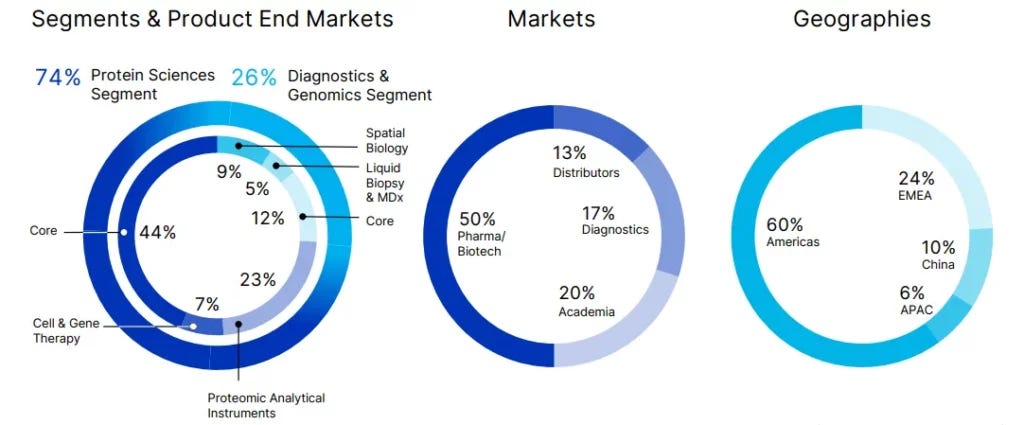

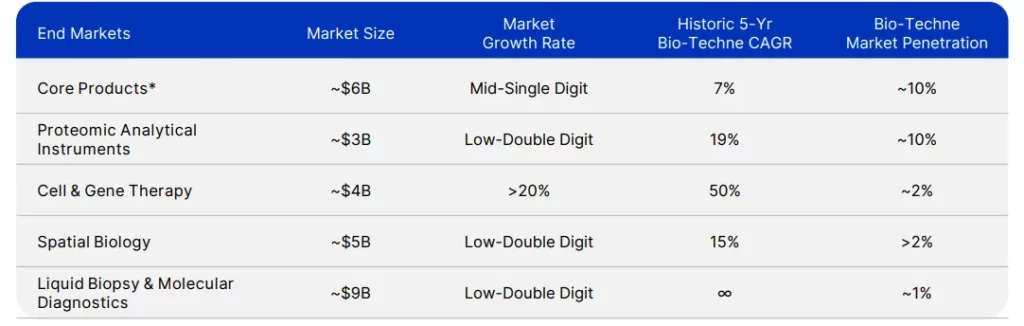

In Part 1, I detailed how Bio-Techne, building off its leading franchise in recombinant proteins, expanded downstream into antibodies, assays, and instrument platforms, before then staking a claim in cell and gene therapy solutions. The smorgasbord of products and use cases across the complex can be organized as follows:

Source: Bio-Techne Corporate Presentation (June 2024)

Protein Sciences and Diagnostics, while two distinct segments, are intertwined in that diagnostics identify biomarkers associated with diseases and those biomarkers then become targets that researchers, using proteins and antibodies from Protein Sciences, develop therapies for. You’ll notice that, notwithstanding the ~20 acquisitions made over the last decade, Bio-Techne’s legacy (”Core”) – proteins, antibodies, and assays within Protein Sciences and hematology controls within Diagnostics and Genomics – continues to make up 56% of total revenue. The remainder is divided across faster growing lines in minimally penetrated TAMs.

Around 50% of revenue is tied to commercial R&D, which has migrated away from big pharma and toward smaller biotechs (~10%-15% of BT’s revenue) who rely on more venture funding, rendering it a more cyclical part of the value chain than it was ~15 years ago. Another 20% comes from academia, a price sensitive segment, hostage to year-to-year budget fluctuations.

Early phase R&D funding trends are less a concern for GMP proteins (7% of revenue), as those are tied to clinical trials and commercial production and are extremely difficult to replace as work migrates beyond the preclinical stage. Here, Bio-Techne is playing catch up to Miltenyi, the industry leader, and Cellgenix (a subsidiary of Sartorius), both of whom established GMP cytokine production capabilities in the early 2000s and have the same strategy of covering ~all phases of the CGT workflow. Bio-Techne boasts a broader array of proteins, but GMP is about mass producing a relatively small number of growth factors, so breadth is far less important than the ability to reliably scale while adhering to strict regulatory standards (whereas none of Bio-Techne’s RUO proteins generate more ~$2mn of revenue, a single GMP protein could realize anywhere between $5mn and $15mn). Still, despite its tardy presence to this niche, BT has established itself as one of a handful of key players.

Through M&A, Bio-Teche also aligned itself with several other buzzy themes, including proteomics and spatial bio. The growth narrative for all this stuff peaked during the COVID years. In its September ‘21 investor day, Bio-Techne guided to ~$2bn of revenue by fy26 on high-teens organic growth. With ~8% growth yielding LTM revenue of just $1.2bn, it’s fair to assume the company will miss this target by a wide margin. In response to deflated expectations, the stock corrected nearly 50% from its 2021 highs.

What happened? Oh, lots of stuff, some of which will sound familiar to anyone who has followed the life sciences space over the last four years. Demand was pulled in anticipation of ongoing COVID-induced shortages and then ahead of inflation-offsetting price hikes, setting the stage for excess inventory destocking in subsequent years. Revenue from China, which comprised 10% of Bio-Techne’s total, swooned 20%-30%. COVID testing tailwinds for ACD probes, Ella, and recombinant spike proteins petered out. The FDA assumed a more cautious stance toward the gene-altering novelty of CGTs, dashing Bio-Techne’s bullish expectations. In 2020, management expected $300mn of CGT-related revenue in five years, with ~$150mn coming from proteins alone, then raised its 5-year target to $500mn+ the following year. With GMP proteins now run-rating at ~$60mn-$70mn, the company appears unlikely to hit either of those figures. Meanwhile, anemic growth, acquisitions, and mix effects have driven EBITDA margins to their lowest level in a decade. With the stock trading at 80x earnings in 2021, everything had to go right and many things did not.

But a number of recent data points (# of orders, growing order sizes, a recovery of biotech funding, the cessation of inventory destocking) suggest that the worst may be over. Organic growth recovered from 1% in fy24 to 9% in the latest quarter1, the best result since 4q22, with instrument revenue expanding by low-single digits last quarter after 2 years of contraction, catching up to the double-digit instrument-specific consumables growth realized in 8 of the last 9 quarters.

That it’s taken ~7k words to detail what Bio-Techne sells and for whom is indicative of the myriad ways in which the company is trying to simultaneously defend its legacy franchises even as it pursues new avenues for growth and diversification. To own more of the value chain claimed by instrument platforms downstream of its antibodies and assays, BT became an instrument provider itself.