[TRUP] Trupanion

Trupanion is a pet medical insurer that promises its members the best value, not the cheapest price. It runs a cost-plus model, targeting a 71% claims ratio (% of premiums paid to vets) for each category, so that if it turns out that vet costs for 3-year old German Shepherds in 97214 run at, say, 50% (90%) of premiums, the company will reduce (raise) prices to bring the category’s claims ratio up (down) to 71%1.

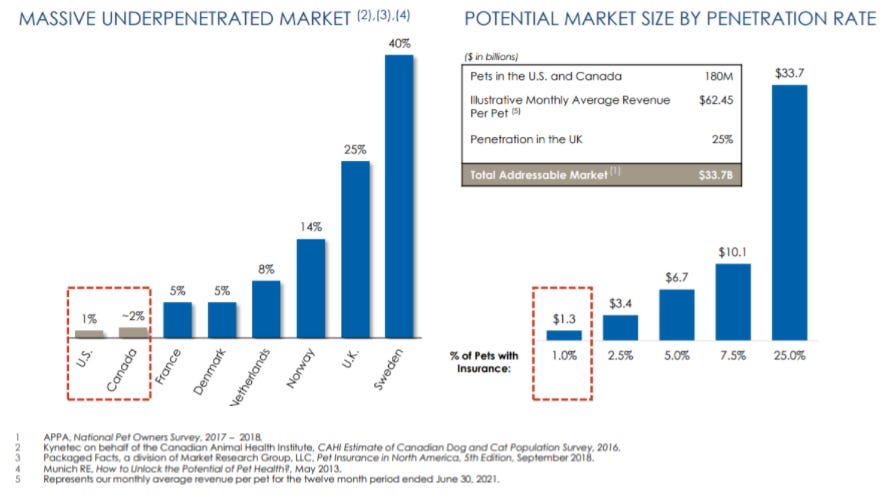

Since its debut in the US nearly 40 years ago, pet medical insurance has penetrated less than 2% of the pet population compared to 25% in the UK.

The disparity reflects product quality differences. Whereas in Western Europe, pet insurance covers what any reasonable pet owner would expect it to, in the US it has historically excluded congenital conditions, imposed caps, and reimbursed according to broad national rates that failed to take into account idiosyncrasies in local vet prices, leaving pet owners feeling bamboozled. Stashing money in a coffee can every month in case of emergencies was a good alternative. Vets were reluctant to recommend medical insurance, lest they suffer the wrath of those with rejected claims. By contrast, in offering fast reimbursement and comprehensive coverage with no gimmicks, carriers in the UK won over vets, who could feel okay about pushing the product to pet owners. Pet insurance was normalized over a decade or two, with vets asking pet owners for their carrier information by default.

It’d be one thing if Trupanion were selling the same ol’ sub-par coverage and growing through aggressive marketing tactics. But in reimbursing 90% of vet costs, including those arising from hereditary and congenital conditions, Trupanion is changing the game. At a time when consumers are increasingly caring for pets as family members, it is able to profitably sell a legitimate, value add product by wielding the following competitive advantages:

1/ Data, 20 years of it, drives ever sharper pricing right down to the neighborhood level. Consistent with its cost-plus model, management likes to say that its job is not to control claims costs but to understand them. Data is critical to this process, as claims payouts should be based on luck rather than systematic mis-pricings across categories. If 3-year old female pugs in Portland, OR are underpriced relative to their risk (i.e., Trupanion is systematically paying out, say, > 90% of premiums in that category) and 2-year old German Shepherds in Brooklyn are overpriced, then over time more 3-year old female pug owners in Portland will select into Trupanion and more 2-year German Shepherd owners in Brooklyn will churn out, giving rise to a disproportionate concentration of low-margin 2-year old/female/Portland pug risk. Granular data allows Trupanion to profitably pay 90% of vet invoices with no caps, which is key to delivering value to pet owners, which is why vets feel okay recommending Trupanion to pet parents, leading to the second advantage…