Wise and the business of cross-border transfers: part 2

Related post:

Wise and the business of cross-border transfers: part 1

I concluded part 1 describing how, by looping unit cost advantages back into price, Wise scaled to become a leading player in cross-border payments. From that starting point, it launched several other notable products. The most significant of these is Wise Account, which allows small businesses and consumers to store and receive money denominated in more than 20 different currencies, in much the same way a local bank account holder would. For instance, a UK business that sells widgets in Estonia can receive euros in its Wise Account and pay those euros to its Estonian employees. Likewise, a British expat living in Estonia can convert pounds to euros in their Wise Account and spend from it or set recurring bill payments, as any Estonian resident with a local bank account would.

Wise Account then sets the foundation for two other product extensions: Wise Debit card and Wise Assets. With a Wise Debit card, customers can spend in as many currencies as Wise supports. Were you a UK citizen spending money in Estonia with, say, a Santander-issued debit card, pounds would be converted to euros at Mastercard’s marked up FX rate. By contrast, with Wise Debit, Wise will draw from euros already held in your multicurrency Wise Account or, if there are no euros there, convert pounds to euros at the same midmarket rate you’d be charged for any other cross-border Wise transfer (that is, Wise pays Mastercard in euros and deducts from your account an equivalent amount of pounds at Wise’s lower conversion rate). With Wise Assets, customers earn a return by investing their Wise Account balances in low-risk interest-bearing assets or in the iShares World Equity Index Fund1.

At the same time that Wise branched from cross-border transfers to multicurrency accounts and cards, they extended their service beyond consumers, to include small businesses (Wise Business) and even the very banks they long competed against (Wise Platform). Compared to winning over consumers with superior user experience and prices, the process for winning SMBs is more elaborate, involving integrations into Xero, QuickBooks, and other software products used by business owners to manage finances and initiate invoices (in fy21, around 9% of business customers connected their accounts with accounting software), and offering other features like invoice templates and automated batch payments to employees and vendors.

In reference to B2B payments, the CFO of MineralTree once remarked, “a payment is not borne a payment, it’s borne an invoice, and then it becomes a payment at the end of a workflow”. It’s likely that SMB volume gains over the next decade will, at the very least, require forays into process automation software, where Wise’s existing strengths don’t come to bear. Wise is up against competitors like Airwallex and Payoneer, who focus exclusively on SMBs and, from the looks of it, provide a wider range of relevant integrations. Even if Wise offers a better rate than businesses can get elsewhere, I can imagine that advantage being more than neutralized by the cash back rewards and working capital benefits realized by paying certain foreign vendors via charge card.

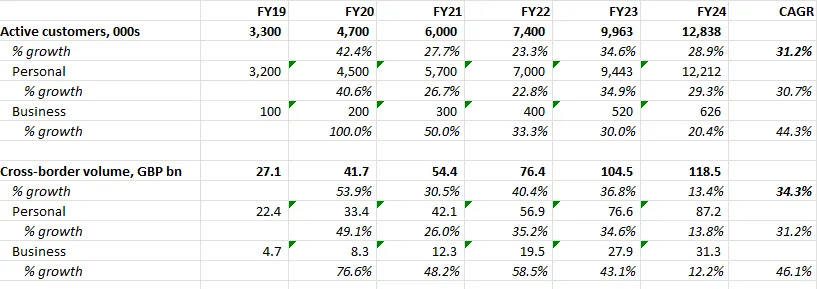

Off a much smaller base, business customers and cross-border volumes have exceeded those of personal customers over the last 5 years…

…though the steep deceleration in Business volumes last fiscal year is worth calling out given that Wise’s £31bn of business volumes are still but a drop against the £7tn of SMB cross-border payments TAM. In the back half of fy24, Wise deliberately halted customer onboarding due to capacity constraints, with decelerating growth continuing into the June ‘24 quarter. But that doesn’t explain why business volumes grew so much slower than accounts.

Wise Platform is a white label offering of Wise’s cross-border payments rails. Bank and fintech customers set different transfer limits on different corridors, park collateral at Wise’s accounts to cover the transfers they expect their customers to make, and leave the rest to Wise. The putative story behind the launch of Wise Platform (you never really know with these stories honestly) is that a small bank in Hungary was having issues handling cross-border transfers through their antiquated systems, so its tellers downloaded the Wise app for customers instead. Since then, Wise has onboarded 85+ partners, mostly neobanks and digital-first businesses like Monzo, agoda, and Brex, but also a handful of traditional banks, including Shinhan and Stanford Federal Credit Union.